- CJEU’s Baštová Judgment and Payment Uncertainty: The CJEU’s ruling in the Baštová case raised questions about whether uncertain payments can be considered taxable consideration, leading to ambiguity regarding when the link between payment and supply is broken.

- Advocate General’s Opinion: In a recent case, the Advocate General suggested that uncertain payments should be treated as valid consideration, challenging the reasoning established in Baštová while still aligning with its outcome. This perspective aims to create a more coherent approach to handling payment uncertainties in VAT law.

- Potential for Conflicting Interpretations: While the Advocate General’s stance may align with practical policy considerations, it appears inconsistent with previous CJEU rulings, particularly in the TP (C-288/22) case, which indicated that uncertain amounts could sever the link to the supplied benefit. There is an expectation that the CJEU will reconcile these interpretations in future rulings to provide clearer guidance on the taxation of uncertain payments.

Source Fabian Barth

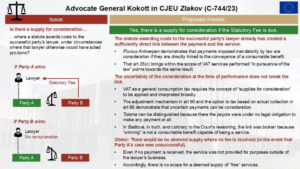

- Taxable Transaction Determination: Advocate General Kokott has concluded that the no-cure-no-pay legal services provided by T.P.T. are supplied for consideration, making them taxable transactions for VAT purposes, regardless of uncertainties regarding payment amounts.

- Legal Context in Bulgaria: Under Bulgarian law, lawyers can provide legal services for free to economically disadvantaged individuals. In this case, T.P.T. offered such a service against Financial Bulgaria EOOD, leading the court to order Financial Bulgaria to pay the statutory fee to T.P.T.

- VAT Implications: T.P.T. requested VAT on the fee awarded by the court, which Financial Bulgaria contested, arguing the services were provided free of charge. However, Advocate General Kokott ruled that the service is subject to VAT based on the fees actually received, meaning Financial Bulgaria is responsible for paying the VAT to T.P.T.

Source Taxlive

See also

- ECJ Case C-744/23 (Zlakov) – AG Opinion – Pro Bono Legal Services are subject to VAT

- Flashback on ECJ Cases C-432/15 (Pavlína Baštová) – Prize money is not a Taxable Transaction for VAT purposes – VATupdate

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Source Fabian Barth