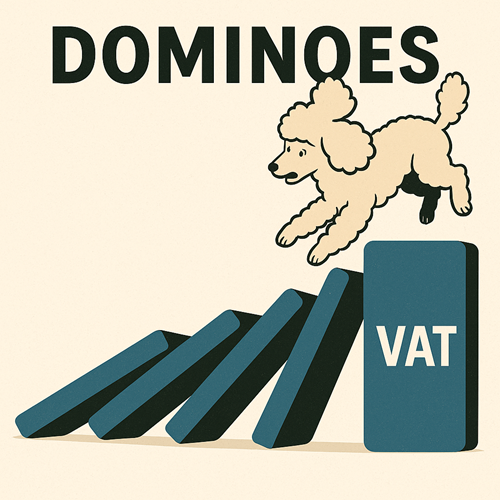

DOMINOES

In 1988, a poodle fell from a balcony in Buenos Aires.

That sentence alone feels like the start of a light-hearted anecdote. But what followed was anything but.

The falling poodle landed on a woman, killing her instantly. A bystander rushed to help and was hit by a bus. A man witnessing the entire scene had a heart attack from the shock and died. Three lives lost—not by intent, design, or disaster, but by a dog with poor balance.

A tragic tale, but also a perfect metaphor for VAT.

Because in VAT, it’s rarely the obvious things that cause the most damage. It’s the little ones—the overlooked tax code, the misassigned supply, the checkbox left unticked. And nowhere is this more obvious than in chain transactions.

Chain transactions are supposed to be elegant. Goods move from A to C, but the paperwork flows A to B to C. It’s a fragile balancing act involving transport, VAT numbers, and the correct allocation of the intra-Community supply. But one tiny error—a mistimed transport, a wrongly attributed customer, a missing VAT ID—can collapse the whole thing.

Suddenly, your zero rate evaporates. Input VAT claims are denied. And the tax authority arrives, looking not for poodles, but penalties.

The worst part? You might never see it coming. Everything looks fine—until it falls on your head.

So this week, remember: in VAT, the smallest things can have the biggest impact. Check the details, confirm the flow, and keep an eye on every step—no matter how minor it seems.

Because in VAT, it’s not always the fraudsters or the complex schemes that cause the damage. Sometimes, it’s just a poodle and a bit of bad timing.

If you have any comments, questions, or ideas that you want to share with us, please send us an email at [email protected] or leave a comment under the posts of this newsletter on LinkedIn.

To go directly to the region, click below:

WORLD

WORLD

- E-Invoicing & E-Reporting developments in the news in week 20/2025

- Understanding Tax Rules for Online Courses: VAT, GST, and Sales Tax Explained

- Is VAT Obsolete? Exploring Split Payment’s Potential to Revolutionize Consumption Taxation

- Why Indirect Tax Teams Should Lead the Way in E-Invoicing Implementations

- Customs and transfer pricing – how to integrate tax strategies in the international supply chain?

- US – Import Tariffs and Reshaping of E-Commerce Trade With China

- China Temporarily Reduces Tariffs on U.S. Imports

- Trump Announces India Offering Tariff-Free Trade

- UK-US Trade Deal & Digital Services Tax: What Tech Firms Need to Know for Future…

- Taxback International Global VAT Guide.

- US and China reach trade deal, as US Department of Commerce initiates investigation on aircraft and jet engines

- EU prepares additional countermeasures against US tariffs while continuing negotiations

- What changes have been announced in the UK-US trade deal?

WEBINARS / EVENTS

- Zampa Webinar: VAT Implications in the Yachting Sector – Discussing Practical Solutions (June 19)

- ecosio Webinar: The Three Main E-invoicing Solution Types Explained (June 5)

- IBFD Stay Ahead in VAT: Global Trends and Challenges Masterclass (June 18 – 20)

- Zampa Partners – Online sessions – Build your knowledge and stay updated with latest trends

- ecosio Webinar: Peppol for Dummies – Understanding the Basics (May 28)

- ecosio Webinar: What Makes a Successful E-invoicing RFP? (May 22)

- IVA Conference – Viva La ViDA! – gain unique insights from experts involved in shaping the future of VAT (May 15…

- Peppol Conference 2025 – eInvoicing and eReporting (Brussels – June 17&18)

MIDDLE EAST

ISRAEL

OMAN

- Oman Advances Digital Tax Transformation with New E-Invoicing System Partnership with Omantel

- Oman Prepares for E-Invoicing Rollout

- Oman issues law on special economic zones and free zones

- Oman Tax Authority and Omantel Collaborate to Launch E-Invoicing System for Digital Transformation

- Oman Tax Authority and Omantel Partner to Launch Advanced E-Invoicing System for Digital Transformation

UNITED ARAB EMIRATES

- Briefing Paper: B2B e-Invoicing in the United Arab Emirates (UAE)

- UAE VAT Rule Change: Impact on Composite Supply Pricing and Industry Practices

AFRICA

AFRICA REGION

EGYPT

- Paper Trails to Digital Rails: Egypt’s Invoicing Portal for B2G, B2B and B2C

- Guidelines for VAT Refunds by the Egyptian Tax Authority: Eligibility and Procedures

KENYA

- Kenya’s Finance Bill 2025 Proposes Tax Reforms on Digital Assets, VAT, and Corporate Incentives

- Finance Bill 2025: Key VAT Measures Expanding Tax Scope and Streamlining Refund Processes

- Finance Bill 2025: VAT Changes on Electronic Services, Refunds, and Exemptions in Kenya

- Kenya Revenue Authority Probes 400 Staff in Multi-Billion Shilling VAT Fraud Crackdown

MOZAMBIQUE

- Mozambique SAF-T and Invoice Reporting

- Mozambican Parliament Exempts Sugar, Oils, and Soap from VAT Until December 2025

- Parliament Unanimously Extends VAT Exemption on Essential Goods (Sugar, Edible Oils and Soap) Until December

- Mozambique Mandates Monthly VAT Invoice Reporting via Electronic System Starting May 2025

- Mozambique Implements New Electronic VAT Invoice Reporting Procedures Starting May 2025

NAMIBIA

NIGERIA

SOUTH AFRICA

- South Africa’s VAT Legal Battle Could Reshape Future Tax Adjustment Processes

- Eswatini’s E-Invoicing Initiative: Advancing Tax Compliance and Digital Transformation by January 2028

- Removal of the plan to expand zero-rated food items Burdens Retailers, Hits Poorest South Africans Hardest

- South African VAT Legislation Changes

- South Africa Advances Towards Mandatory E-Invoicing to Combat Tax Fraud by 2028

- Eswatini Seeks Fiscalization Technology (E-Invoicing) Solutions

TANZANIA

AMERICAS

ARGENTINA

BRAZIL

- Implementation of Alphanumeric CNPJ in Brazilian Electronic Fiscal Documents

- Brazil’s Technical Note 2025.002: Preparing for the 2026 VAT Implementation

- Brazil’s Consumption Tax Reform: Transforming Agribusiness with New VAT System and…

- Brazil Implements New VAT and Selective Tax on Harmful Goods and Services in 2025 Reform

CANADA

- Understanding the 2025 GST/HST New Housing Rebate for Ontario Homebuyers

- GST/HST Returns and Rebates Processing Program: Enhancing Tax Compliance and Service Modernization

- Canada Announces Indirect Tax Relief for Businesses Affected by U.S. Tariffs

- Canada Introduces Indirect Tax Relief for Businesses Impacted by U.S. Tariffs in 2025

- Tax Court Confirms MedSleep’s 80/20 Fee-Sharing Agreement with Physicians Valid for GST/HST Purposes

- Canada Implements Destination-Based GST/HST for Non-Resident Digital Service Providers and…

- Canada Implements Destination-Based GST/HST for Non-Resident Digital Service Providers and Platforms

CHILE

- How does E-Invoicing work in Chile

- Chile to Implement VAT Deemed Supplier Rules for Digital Marketplaces Starting October 2025.

- Chile Issues New VAT Guidelines for Marketplaces and Low-Value Goods, Effective October 2025

- Chile Implements New VAT Rules for Online Marketplaces and Low-Value Goods Transactions

GUATEMALA

- How the Online Electronic Invoice Regime – FEL of Guatemala works

- New Income Threshold for Small Taxpayers Impacts Consumer Industry Companies’ Tax Strategies

GUYANA

PARAGUAY

PERU

- Congress Grants Special Input VAT Credit Eligibility to San Martin Department in Amazon Region

- Peruvian Tax Authority amends guidelines to determine whether services qualify as digital services

PUERTO RICO

UNITED STATES

- Puerto Rico Revises Hurricane Preparedness Sales Tax Holiday Dates to May 23-26, 2025

- Understanding Sales Tax: Key Concepts, Compliance, and Business Implications Across U.S. Jurisdictions

- Arkansas exempts food and food ingredients from state sales and use taxes

- Essential Sales Tax Compliance Checklist for New Business Owners by Sarah Craig

- Indiana Raises Electronic Cigarette Tax Rate to 30%

- How to Expand into the US without Breaking Compliance Rules

- US Sales Tax Rate Updates for April 2025

- Utah Repeals 200 Transaction Sales Tax Threshold for Remote Sellers

- Understanding US Sales Tax Exemption Certificates for Retail and E-commerce Compliance

- Wisconsin DOR Reminds Businesses that Imposed Credit Card Fees Are Part of Taxable Sales Price

- Guide to Mississippi Second Amendment Sales Tax Holiday: Dates, Eligibility, and Guidelines

- Northern Illinois Leaders Debate Reinstating Local Grocery Tax to Offset Revenue Losses

- Alabama House Bill 191: Local Governments Gain Control Over Sales Tax Exemptions

- Washington’s Digital Ad Sales Tax Legislation Is a Legal and Economic Minefield

- Understanding Sales Tax on Labor: Exemptions and Charges for Various Professions in California

- Virginia Governor Signs Law Raising Electric Utility Consumption Tax Rates Effective July 1

- Ensure Accurate Sales Tax Collection with California’s Online Lookup Tool

ASIA-PACIFIC

AUSTRALIA

- Guide to GST Registration and Income Reporting for Taxi and Ride-Sourcing Providers

- List of Australian Government Entities Registered for eInvoicing on Peppol Network

AZERBAIJAN

BANGLADESH

CAMBODIA

- Cambodia’s GDDE Launches B2G CamInvoice, Aiming for Mandatory B2B and B2C Use by 2026

- E-invoicing in Cambodia: Centralized Clearance Model

CHINA

- China’s First Formal VAT Law Introduces Major Changes, Effective January 2026

- Henan Announces Standards for Land Value-Added Tax Exemption Policy Implementation

FIJI

GEORGIA

INDIA

- Supreme Court to Rule on GST Impact for India’s Online Gaming Industry

- Indirect Tax Fortnightly Update – Key Developments in May 2025

JAPAN

KAZAKHSTAN

NEW ZEALAND

- New Zealand Updates GST Rules for Online Marketplaces on Listed Services Transactions

- New Zealand Proposes Mandatory E-Invoicing for High-Volume B2G Transactions by 2026

PAKISTAN

- OICCI Urges FBR to Reinstate Sales Tax on Petroleum Products in 2025-26 Budget

- Pakistan Extends Deadlines for e-Invoicing Integration for Taxpayers

- Pakistan Plans to Abolish Sales Tax on Local Cotton in 2025-26 Budget Reform

PHILIPPINES

- Philippines Issues VAT Guidelines for Cross-Border Digital Services

- Philippines e-Invoicing: Tax Deductions and Compliance Under the CREATE MORE Act

- Philippine Court Grants Partial VAT Refund for Importation of Exempt Prescription Drugs and Medicines

- Understanding VAT Liabilities for Non-Resident Digital Service Providers in the Philippines

SINGAPORE

SOUTH KOREA

TAIWAN

- Reminder for Domestic Buyers on Cloud Invoices and VAT for Overseas E-commerce Services

- Healthcare Institutions Must Register and Pay Business Tax for Non-Medical Goods and Services Sales

THAILAND

VIETNAM

- Hanoi Proposes 2% VAT Cut on Select Goods to Boost Economy and Consumer Spending

- Cash Register e-Invoicing to Boost Private Sector

- Vietnam E-Invoicing: Requirements, Challenges and Solutions

- Decree 70/2025: Important updates to electronic invoices effective June 1, 2025

- Proposal to Extend VAT Reduction to Support Economic Recovery and Growth in 2025-2026

- VAT Reduction Policy Aims to Support Citizens and Businesses, Excludes Certain Sectors

- Vietnam Proposes Special Tax on Petrol to Meet Environmental Goals and Reduce Pollution

EUROPE

EUROPE

- Briefing Document: SAF-T Implementation Across Europe

- 2025 VAT Rates in Europe: Country Rates & Changes

EUROPEAN COURT OF JUSTICE

- Agenda of the ECJ VAT cases – 1 Judgment, 2 AG Opinions and 1 Hearing till June 19, 2025

- Briefing document: ECJ C-782/23 (Tauritus) – Customs Value Determination for Provisional Prices in…

- Comments on ECJ C-527/23: EU Court Rules on VAT Deduction for Intra-Group Administrative…

- Comments on ECJ C-615/23: Transport Compensation Not Subject to VAT for Public Service Losses

- Briefing document: ECJ Rulings on Reductions of the Taxable Amount through Rebates

- Comments on ECJ C-615/23: Subsidy afterwards for losses of passenger transport not subject to VAT

- EU Court Rules VAT Exemption Applies to Non-Commercial Imports Across EU, Not Just Poland

- Comments on ECJ C-405/24: Failure to grant VAT exemption on small consignments of a non-commercial character in violation of EU law

- Comments on ECJ C-744/23: AG Opinion – No-cure-no-pay service is a VAT-taxed transaction

- ECJ Customs C-782/23 (Tauritus) – Judgment – Customs Value Determination for Provisional Prices in Imports

- Flashback on ECJ cases C-217/94 (Eismann Alto Adige Srl) – Accompanying Documents for…

- GC VAT Case T-198/25 (G. Kft) – Questions – Are VAT corrections and refunds only possible if new…

- Comments on ECJ Customs C-72/24 & C-73/24: Calculation of customs value in Greek textile smuggling according to AG EU in violation of EU law

EUROPEAN UNION

- EU Parliament Urges Increased AI Use to Combat VAT Fraud and Protect EU Budget

- EU VAT Committee 127th meeting on May 14. 2025: Agenda & Working Papers

- EU VAT Committee – Barter Transactions: Italy’s Concerns and Commission’s Clarifications

- Podcasts & briefing documents: VAT concepts explained through ECJ/CJEU cases on Spotify

- EU Proposes Shifting VAT Liabilities to Suppliers and Marketplaces for Low Value Consignments

- Important Update of Amazon’s Pan-EU Program

- EU Finance Ministers Agree on New VAT Approach to Simplify E-commerce Imports and Compliance

- EU Council Approves Directive Making Foreign Traders Liable for Import VAT Compliance

- EU’s New Cross-Border SME Scheme: VAT Exemption for Small Enterprises

- CBAM: Apply for the status of authorised CBAM declarant

- Big step for Simplification: Commission publishes consolidated list of Classification Regulations

- VAT rules: Council agrees position on directive simplifying tax collection for imports

- EU Council Agrees on Directive to Boost VAT Import One-Stop-Shop Usage

- EU DAC 9 Directive: What Multinational Enterprises Need to Know About Pillar 2 Global Minimum Tax Changes

- EU States Green Light VAT Changes For Importers, Platforms

- EU Economic and Financial Affairs Council Agrees on Directive for New VAT Rules Making Foreign Traders and Platforms Liable for VAT on Imports

- EU Approves New VAT Rules for Importers and Platforms to Boost Compliance and Revenue

- EU Ministers to Approve VAT Reform for E-commerce Imports, Simplifying Compliance and Eliminating Threshold

- Briefing Document: Comprehensive Review of EU VAT Deduction Rules and Invoice Requirements Based on ECJ Case Law

- The importance of the invoice for VAT purposes

- Mastering VAT Compliance and CBAM: Essential Guide for Global Sellers in 2025

- EU Council Agrees on VAT Directive to Simplify Import Tax Collection and Boost IOSS Use

- Briefing Document: EU VAT and Land Sales by Spouses (C‑213/24 Grzera)

- ECOFIN to Discuss VAT Directive for Distance Sales of Imported Goods on May 13, 2025

- BFH Seeks EuGH Clarification on Whether “Scraps” Qualify as Smoking Tobacco

- EU to Tighten VAT Regulations on Imports Starting July 2028

- EU Approves €5 Billion French Scheme to Boost Wine and Spirits Exports to US

- New Patch-Release of the Franco-German E-Invoice Format published Factur-X 1.07.3 / ZUGFeRD 2.3.3 available now

- Portugal Convicts 23 in €2.9 Billion International VAT Fraud Case, First in EU Investigation

EUROPEAN UNION – ViDA

ALBANIA

- Albania Enforces 20% VAT on non-resident Digital Services, Requires Tax Representative Registration

- Albania Enforces VAT Compliance and Tax Representation for MNCs Offering Digital Services

AUSTRIA

BELGIUM

- Five Key Questions About Belgium’s Upcoming B2B e-Invoicing Mandate

- Belgium’s 2026 Mandatory e-Invoicing Requirement

- Unreasonable costs and deduction of input VAT. Judgments of the Court of Cassation – May 13, 2025

- New VAT Chain: Understanding the Updated VAT Refund Procedure Effective 2025

BULGARIA

- Briefing document: SAF-T Implementation in Bulgaria as of Jan 1, 2026

- Bulgaria Implements SAF-T for Enhanced Digital Tax Compliance and Reporting Requirements

- Bulgaria Releases SAF-T Schema and Guidelines Ahead of 2026 Mandate Implementation

- Bulgaria Set to Launch SAF-T Reporting in 2026

- NRA holds public consultations on draft order for SAF-T submission

- Bulgaria’s Euro Transition: Key Authorities Overseeing Compliance and Consumer Protection

CROATIA

DENMARK

- Court Upholds Conditional Sentence, Overturns Deportation for Tax Evasion at Airport

- Denmark Enforces Digital Bookkeeping for VAT-Registered Entities from January 2026

- Court Upholds Conditional Sentence for Tax Evasion, Overturns Deportation Order for Airport Incident

- Briefing Document: Digital Reporting and E-invoicing in Denmark

ESTONIA

FRANCE

- French Tax Authority Updates PDPs on E-Invoicing Reform and New Compliance Requirements – Latest Update

- France Establishes New Invoice Standards for Harmonized E-Invoicing Ecosystem

- Exceptional Extension of Temporary Fiscal Representation for VAT Announced on May 14, 2025

- VAT Rules for Composite Offers: Update Following Public Consultation and Court Rulings

- VAT Application and Territoriality: Composite Offers and Fiscal Treatment Guidelines

- VAT Application and Territoriality: Composite Offers and Taxation Principles

- Public Consultation on VAT Rules for Art, Collectibles, and Antiques Effective January 2025

- VAT Scope and Territoriality: Composite Offers, Principles, and Definitions for Economic Operations

- VAT Application Guidelines: Reduced Rates, Conversion Coefficients, and Public Consultation Details

- VAT Scope and Territoriality: Composite Offers, Principles, and Definitions for…

- Update External B2B E-Invoicing specifications

- VAT on Employee Vehicle Provision: Tax Administration Clarifies Applicable Regime and Implications

GERMANY

- Tax Exemption for Care Services: Indirect Cost Bearing and Personal Budget Considerations

- Personal Budget and VAT Exemption: BFH Ruling on Care Services and Indirect Cost Coverage

- Federal Audit Office Criticizes Slow Progress on Germany’s National E-Reporting System…

- eZOLL App Expands User Base to Include Businesses and Individuals for Customs Declarations

- ECJ Rules Compensation Payments for Public Transport Not Subject to VAT Liability

- Who can deduct input tax? A guide for companies in Germany

- Tax Treatment of Bonus Payments in Central Regulation Business: German Federal Fiscal Court Ruling

- Late Submission of VAT Documents as Gross Negligence; No EU Right to Amend Tax Notices

GREECE

- EU Agrees on New VAT Approach to Simplify E-commerce Imports and Compliance

- Greece’s e-Transport System: Key Deadline Changes and What Businesses Need to Know

HUNGARY

ITALY

- New VAT Rules for Employee Secondment: Subjective, Objective, and Territorial Criteria Explained

- No Immediate Solution for Non-Operational Companies’ VAT Credit Recovery, Awaiting EU Court Ruling

- Tax Exemption for Non-EU Clients: VAT Rules for Italian Accountants Explained

- VAT Treatment of Staff Secondment Post-1988 Law Repeal: Operational Guidelines and Compliance

- Abolition of ONLUS Regulations May Affect VAT Exemption with Transition to Third Sector

- Challenges of OSS and Split Payment Interaction for Foreign Suppliers in Institutional Purchases

- No Immediate Solution for Non-Operational Companies’ VAT Credit Recovery, Awaiting Legal Clarification

- Impact of ONLUS Abrogation on VAT Exemption: Transition to Third Sector Challenges

- VAT Rate on Ancillary Services: Legal Framework and Implications for Indirect Taxation

- EU Court Rules Transport Compensation Not Subject to VAT as It is Not a Service Payment

LATVIA

LITHUANIA

- Lithuania to Increase Reduced VAT Rate from 9% to 12% in January 2026

- ECOFIN Agrees on New VAT Rules Making Sellers Responsible for Import Tax Payment

LUXEMBOURG

MALTA

MOLDOVA

NETHERLANDS

- Pension Fund Not Exempt from VAT, Court Rules Against Stichting X’s Appeal

- Netherlands – Transfer Pricing and Customs Valuation

- Court of Appeal The Hague: Pension Fund Not Qualified for Collective Investment, VAT Rightly Paid on…

- Court of Appeal The Hague: Pension Fund Not Qualified for Collective Investment, VAT Rightly Paid on Services

- Netherlands Updates VAT Invoicing and Administrative Rules with New Decree Effective May 2025

- Doubts by the Advocate General about determining customs values with a ‘Fair Price List’

NORWAY

- SAF-T in Norway: Declaration, Requirements & Deadlines

- Norway Implements Digital Platform Information Reporting Rules Aligned with OECD and EU…

POLAND

- New VAT Rules for Small Businesses in the EU Starting 2025

- Poland Raises VAT Registration Threshold to PLN 240,000 – Key Information for Businesses

- Prepare for KSeF 2026: Transition from Paper Invoices to Avoid VAT Penalties

- Uncertainty Over VAT Exemption for Summer Camps: Awaiting Finance Ministry’s Interpretation

- Poland’s New FA(3) E-Invoicing Schema: Key Changes and Enhancements Explained

- Poland Suspends E-Invoicing Penalties Until 2026, Allowing Businesses Time to Adapt

- Poland to Implement New E-Receipt Regulations from July 2025 for Businesses

- Poland Releases New Draft of KSeF FA(3) Schema with Key Updates and Features

- Poland’s MoF Publishes Draft Amendment to VAT Act for Mandatory E-Invoicing System KSeF

- Architectural-Building Project Should Be Taxed at 23% VAT Rate, Court Rules

- EU Court Ruling: Municipal Transport Subsidies Exempt from VAT, Benefits for All Stakeholders

- How to Account for VAT and CIT on Lease Deposit Payments

- Mastering Polish Invoicing: Navigate Regulations, E-Invoicing, and the KSeF System

- Minister’s Response on Zero VAT Rate Proposal for Public Transport Interpellation No. 2217

PORTUGAL

- Portugal’s Solar VAT Rate to Increase from 6% to 23% in July 2025

- SAF-T in Portugal: Declaration, Requirements & Deadlines

ROMANIA

- ANAF Identifies Undeclared VAT Over 1.1 Million Lei in Suceava Construction Company Fraud

- SAF-T in Romania: Declaration, Requirements & Deadlines

RUSSIA

SLOVAKIA

- Understanding VAT Payer Identification in Slovakia: Key Changes for 2025

- Slovakia Launches Import VAT Postponement Scheme

- Briefing Document: Slovakia Mandatory B2B E-Invoicing

SLOVENIA

- Overview of Slovenia’s VAT System and Legislative Updates as of May 2025

- VAT Calculation and Deduction Records Solution Available on eDavki from July 1, 2025

- Slovenia’s Tax Authority Launches 24/7 AI Chatbot for VAT and Tax Information Access

SPAIN

- Intrastat Threshold Rules and Reporting Obligations for Businesses in Spain

- Briefing document: Spain’s VeriFactu Verified Billing System

- Understanding Spain’s Royal Decree 1007/2023: Digital Billing Records and Fiscalization Compliance

- Understanding Spain’s Royal Decree 1007/2023: Digital Billing Records and Fiscalization…

- DGT Ruling: Insurance Portfolio Transfer Subject to VAT Due to Lack of Economic Unit

- Pending Operations After Retirement: VAT Obligations for Concluded or Pending Legal Matters

SWEDEN

SWITZERLAND

- Switzerland To Extend Cut-Rate VAT For Hotel Stays

- Switzerland Extends Reduced VAT Rate for Hotels Beyond 2027

- Federal Supreme Court Ruling about entity that received funding in 2020 from the Zurich Film Foundation

TURKEY

UKRAINE

- VAT Registration Cancellation During Reorganization: Mergers, Transformations, Divisions, and Successions Explained

- VAT and Free Transfer of Goods and Services: Key Taxation Rules to Know

- How to Correctly Fill Out Appendix D3 for VAT Refund from SEA VAT System

- SAF-T in Ukraine: Declaration, Requirements & Deadlines

UNITED KINGDOM

- Finance Act 2025: Increased Penalties for Late Tax Payments Effective 31st May

- VAT Amendment Regulations 2025: Final Return Extensions and Registration Changes

- Isle of Man: Interest rates for VAT and other indirect taxes

- Mastering UK VAT Compliance: A Comprehensive Guide to Understanding and Applying VAT Codes

- Navigating VAT and Tax Challenges: Opportunities for Universities and Higher Education Institutions

- UK E-Invoicing Models: Centralized vs. Decentralized Approaches as Consultation Ends

- New VAT Regulations 2025 Allow HMRC to Extend Final Return Submission Deadlines

- Government Seeks Input on New VAT Relief for Charitable Goods Donations to Aid Needy

- Research and analysis: Early impacts of penalty reform on VAT-registered businesses

- Form: Request transfer of a VAT registration number

- Understanding the VAT Reverse Charge for Construction Services: Key Features and Application Guide

- CIOT and ICAEW Respond to UK Government’s Electronic Invoicing Consultation

- UK Government Reviews VAT Collection and Low Value Import Threshold in E-commerce Sector

- Effective E-Invoicing Implementation Crucial for Boosting UK Business Adoption, Says Tax Institute

- Government Announces Changes to Capital Goods Scheme for Simplified VAT Reporting

- UK Government Announces Reforms to Simplify Temporary Admission Procedure for Importers by 2025

- UK Government Reviews VAT Collection and Low Value Import Threshold in…

- FTT Rules ConquerMaths as VAT Liable, Not an Examination Service, Dismissing GM’s…

- HMRC Lowers Interest Rates for Late Tax Payments After Base Rate Reduction

- FTT Rules Aligners as Dental Prostheses, Granting VAT Exemption for Align Technology…

- Tribunal Rules ConquerMaths Not Exempt as Examination Service Under VATA 1994

- Yorkshire Director’s £7.4m VAT Fraud Appeal Dismissed After Tribunal Non-Cooperation

- FTT Rules Aligners as Dental Prostheses, Granting VAT Exemption for Align Technology Switzerland GmbH

- UK Tax Tribunal Rules Intravenous Vitamin Drips Exempt from VAT as Medical Care Supplies

- UK Tax Tribunal Rules Advance Payments Not Subject to Additional Import VAT in Bottled Water Case

Latest Posts in "World"

- E–invoicing Developments Tracker

- OECD Report: Effective Carbon Rates 2025 – Recent Trends in Taxes on Energy Use and Carbon Pricing

- Country Profiles on E-Invoicing, E-Reporting, E-Transport, SAF-T Mandates, and ViDA Initiatives

- Blog Ahu Ocak Caglayan: Field Notes from Recent Mandates: Patterns, Pitfalls, and Practical Fixes

- Book by Darko Pavic: The Fiscalization Compliance Maturity Model