Summary

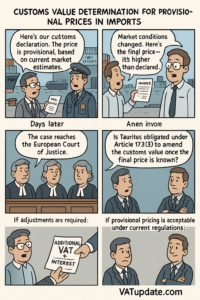

- Imports: Tauritus UAB imported diesel and jet fuel into Lithuania between October 1, 2015, and April 30, 2017, using contracts that specified provisional prices.

- Provisional Pricing: The contracts allowed for adjustments to the provisional price based on market factors and exchange rates, leading to final invoices that could differ from the initial price.

- Customs Declarations: Tauritus declared the provisional price as the customs value and used the residual method for valuation.

- Audit Findings: During a customs audit in May 2017, it was discovered that Tauritus had not adjusted the customs value despite receiving final invoices indicating higher prices, resulting in unpaid additional VAT.

- Customs Authority’s Action: The customs authorities applied the transaction value method, claiming additional VAT and late payment interest based on the final prices.

- Legal Challenge: Tauritus contested the decision, arguing that the final price was unknown at the time of declaration, leading to questions referred to the Lithuanian Supreme Administrative Court regarding the interpretation of EU customs regulations.

Key Points of the Judgment:

- Transaction Value Method: Article 70 of the UCC establishes that the primary method for determining customs value is based on the transaction value, which is the price actually paid or payable for goods at export. The court concluded that if a final price is determinable based on objective factors (e.g., market prices, exchange rates) specified in the sales contract, the transaction value method can still be applied even if that final price is not known at the time of declaration.

- Provisional Pricing: The court emphasized that while only a provisional price might be known at the time of declaration, if the contract stipulates that this price will be adjusted according to predetermined factors, the transaction value should reflect the final price once it is determined.

- Simplified Customs Declaration: The judgment recognized the use of a simplified customs declaration procedure, allowing for the initial declaration based on the provisional price followed by a supplementary declaration once the final price is known. This procedure helps ensure compliance with the obligation for accuracy in customs declarations.

- Rectification of Customs Declarations: The second question regarding the obligation to request an adjustment to the customs declaration once the final price is known was deemed unnecessary to answer since the court concluded that the customs value should have been declared based on the transaction value method from the outset.

Implications:

- Compliance with Customs Regulations: Importers must ensure that they provide accurate customs declarations, reflecting the true economic value of the goods, even when dealing with provisional pricing.

- Flexibility in Customs Procedures: The ruling affirms that customs procedures can accommodate changes in pricing structures, thereby preventing arbitrary customs values.

- Legal Precedent: This decision may serve as a precedent for similar cases involving provisional pricing and customs declarations across the EU, reinforcing the importance of transparency in the determination of customs values.

Detailed analysis

Subject: Interpretation of Articles 70 and 173(3) of the Union Customs Code (UCC) concerning the determination of customs value based on transactional value when goods are imported with a provisional price, and the subsequent obligation to rectify customs declarations.

Case Background:

- Parties: Tauritus UAB (importer) and Lithuanian Customs Department.

- Dispute: Tauritus imported fuel (diesel and jet fuel) under contracts with provisional pricing. The final price was determined later based on factors unknown at the time of customs declaration (e.g., average market prices, exchange rates).

- Tauritus’s Actions: Declared goods using the provisional price as customs value, applying the “fall back” method (Article 74(3) UCC). Generally sought rectification after final invoices were received, but failed to do so for thirteen declarations.

- Customs Actions: After a post-clearance audit, applied the transactional value method (Article 70 UCC) based on the final invoice prices. Demanded supplementary import VAT and late payment interest.

- Legal Question: The core issue referred to the CJEU by the Lithuanian Supreme Administrative Court is whether the transactional value method (Article 70 UCC) is applicable when only a provisional price is known at the time of declaration, and whether there is an obligation to rectify a declaration made under the “fall back” method (Article 74 UCC) once the final price is known.

Key EU Legal Framework:

- Union Customs Code (UCC) – Regulation (UE) No 952/2013:

- Article 15(2)(a): Declarant is responsible for the accuracy and completeness of information in the customs declaration.

- Article 48: Post-clearance controls by customs authorities.

- Article 70: Transactional value method (primary method for determining customs value). The value is the “price actually paid or payable” for the goods. Excludes conditions or considerations whose value is not determinable for the goods being valued.

- Articles 71 & 72: Adjustments to the transactional value.

- Article 73: Simplification of valuation where certain amounts are not quantifiable at the time of declaration (requires authorization).

- Article 74: Secondary methods for determining customs value, used when Article 70 is not applicable. Includes transactional value of identical/similar goods, deductive value, computed value, and the “fall back” method (Article 74(3)). The methods are hierarchical.

- Article 101: Determination of import/export duty amounts.

- Articles 166 & 167: Simplified customs declarations and supplementary declarations. These are considered a single, indivisible act taking effect from the date of acceptance of the simplified declaration.

- Article 172(2): Date of acceptance of the declaration is generally the date for application of customs provisions.

- Article 173: Rectification of customs declarations. Allows for rectification within three years after release of goods to fulfill obligations related to the customs procedure.

- Delegated Regulation (UE) 2015/2446:

- Article 71: Conditions for authorization under Article 73 UCC (disproportionate administrative cost of simplified procedure, and value not significantly different).

- Implementing Regulation (UE) 2015/2447:

- Article 128(1): Transactional value is fixed at the time of acceptance of the declaration, based on the sale immediately preceding introduction into the EU customs territory.

- Article 130: Reductions are considered if the sales contract provides for them and their amount at the time of declaration acceptance. Reductions from contract modifications after declaration acceptance are not considered.

- Article 133: Value of conditions or considerations determinable for the goods is considered part of the price paid or payable.

- Article 144(1): “Fall back” method (Article 74(3) UCC) allows for reasonable flexibility and should be based on previously determined customs values.

- VAT Directive 2006/112/CE

- Article 85: Import VAT taxable amount is the customs value.

- Article 273: Member States can impose obligations to ensure correct VAT collection and prevent fraud.

Main Themes and Most Important Ideas/Facts:

- Hierarchy of Customs Valuation Methods: The UCC establishes a strict hierarchy of methods for determining customs value, with the transactional value (Article 70) as the primary method. Secondary methods (Article 74) are only to be used when the transactional value cannot be determined. The “fall back” method (Article 74(3)) is the last resort.

- Definition of Transactional Value: The transactional value is the “price actually paid or payable” for the imported goods. This includes all payments made or to be made as a condition of sale.

- Provisional Pricing and Determinability: The Court addresses the question of whether a provisional price, subject to future adjustment based on objective factors, allows for the application of the transactional value method. The crucial element is whether the final price is determinable at the time of importation, even if not yet determined.

- Determinable Value of Conditions/Considerations: Article 70(3)(b) UCC excludes the transactional value method if the price is subject to conditions or considerations whose value is not determinable. The Court suggests that in the Tauritus case, the final price was determinable because the adjustment depended on objective, predetermined factors outside the parties’ control.

- Applicability of the “Price to be Paid”: The Court emphasizes that Article 70 UCC refers to the “price actually paid or payable,” indicating that the final price, even if fixed later, constitutes the transactional value if it was determinable at the time of importation.

- Simplified Declaration Procedure: The Court highlights the importance of the simplified declaration procedure (Articles 166 and 167 UCC) as the appropriate mechanism for handling situations where the final price is not known at the time of the initial declaration. This procedure allows for a simplified declaration with a provisional value, followed by a supplementary declaration with the final value once known.

- Simplified Determination of Value (Article 73 UCC): The Court notes that the simplification under Article 73 UCC is likely not applicable in circumstances like Tauritus’s, as it requires authorization and specific conditions (disproportionate administrative cost of simplified procedure and minor difference in value).

- Rectification of Declarations (Article 173 UCC): The second question regarding the obligation to rectify a declaration made under Article 74(3) is not answered directly by the Court because the first question establishes that Article 70, using the simplified procedure, should have been applied. This implies that if the correct method had been used (Article 70 with simplified procedure), the issue of rectifying a declaration based on an incorrect method (Article 74) would not arise in the same way. However, the Court’s stance on the applicability of Article 70 and the simplified procedure suggests that the declarant is obligated to ensure the final value is reflected, presumably through the supplementary declaration mechanism.

- No Fraudulent Intent Does Not Excuse Non-Compliance: The Court explicitly states that the absence of fraudulent intent does not excuse non-compliance with the obligation to provide accurate and complete information in the customs declaration (Article 15 UCC). Any failure to observe customs law is considered an “infringement of customs legislation,” regardless of intent.

- Impact on Late Payment Interest: While the dispute in the main proceedings concerns late payment interest, the Court’s focus is on the correct determination of the customs value (and thus the VAT base). The correct determination of the tax debt and its due date are necessary to assess the legality of the late payment interest demand.

Key Quotes:

- “…the transaction value of the goods constitutes the ‘primary basis for determining the customs value,’ and, on the other hand, the use of other bases for determining this value falls under ‘secondary methods,’ which should only be used ‘[w]hen the customs value of the goods cannot be determined by applying [this] Article 70.'” (Point 52)

- “…it follows from the very wording of Article 70 of the Union Customs Code that this transaction value may correspond not only to the ‘price actually paid’ for the goods in question but also to the ‘price to be paid’ for those goods.” (Point 61)

- “…Articles 166 and 167 of the Union Customs Code provide for a simplified customs declaration procedure that allows for consideration of a contractual revaluation of the transaction value of the goods…” (Point 63)

- “…in circumstances such as those in the main proceedings, recourse to the simplified customs declaration procedure provided for in Articles 166 and 167 of the Union Customs Code allows, on the one hand, for declaring a customs value that, in accordance with the priority method of transaction value, reflects the real economic value of the imported goods… and, on the other hand, satisfies the obligation of accuracy and completeness imposed by Article 15(2)(a) of that code…” (Point 66)

- “…the fact that the declarant acted without fraudulent intent is irrelevant.” (Point 76)

Conclusion:

The Court ruled that when goods are imported with a provisional price that will be adjusted later based on objective, predetermined factors, the customs value should be determined using the transactional value method (Article 70 UCC). This is possible because the final price is considered “determinable” at the time of importation, even if not yet known. The appropriate procedure for such situations is the simplified customs declaration procedure (Articles 166 and 167 UCC), which allows for an initial declaration with the provisional price followed by a supplementary declaration with the final price. The absence of fraudulent intent does not negate the obligation to provide accurate and complete information. The ruling emphasizes the strict hierarchy of valuation methods and the requirement to use the transactional value method whenever possible. The second question on rectification under Article 74 is not answered because the Court determined that Article 70 is the applicable method in such circumstances.

See also

- Join the Linkedin Group on ECJ/CJEU/General Court VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- ECJ State Aid C-360/25 (X) – Questions – Legal Validity of the Bank-to-Bank VAT Exemption

- EU and Indonesia conclude negotiations on free trade agreement

- ECJ Case: VAT Treatment of Loyalty Points vs Vouchers Under EU Directive

- FISC Hearing on Tax Implications of Trump Administration Policies September 23

- VAT Rules for Virtual Game Currencies: EU Court Advocate General Opinion