- Amendments to VAT Implementing Regulations published on 18 April 2025

- Changes followed a public consultation by ZATCA in August 2024

- Deadline for taxpayer submissions was 17 September 2024

- ZATCA released a guide on the amendments on 22 April 2025

- Notable changes may impact business operations

- Taxpayers need to update internal policies and procedures

Source: insightplus.bakermckenzie.com

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "Saudi Arabia"

- Saudi Arabia to Launch E-Invoicing Wave 24 by June 30, 2026

- Saudi Arabia Announces Criteria for 24th Wave of VAT E-Invoicing System Integration

- Mandatory Shipment Certificate for Imports to Saudi Arabia Starting October 2025

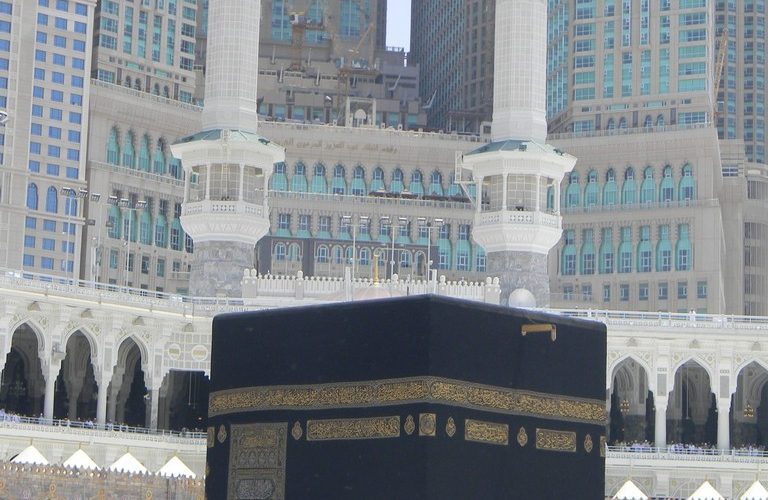

- Saudi Arabia Introduces VAT Refund Program for Tourists and GCC Nationals to Boost Tourism

- Briefing document: Saudi Arabia FATOORAH E-invoicing Compliance