- VAT Increase Controversy: South Africa’s Finance Minister Enoch Godongwana has warned that failing to raise the value-added tax (VAT) rate from the current 15% by 0.5 percentage points on May 1 could severely harm the country’s finances and threaten the stability of the coalition government.

- Political Tensions: The proposal to increase VAT has led to significant conflict between the two largest coalition parties, the African National Congress (ANC) and the Democratic Alliance (DA), with the DA challenging the legality of the increase in court and advocating for expenditure cuts instead.

- Financial Implications: Godongwana stated that halting the VAT increase would result in lost revenue essential for meeting budgeted spending commitments, potentially forcing the government to make drastic cuts or increase borrowing. The National Treasury estimates that the VAT hike could generate approximately 13.5 billion rand in additional revenue for the 2025/26 financial year.

Source Reuters

- VAT Increase Defense: Finance Minister Enoch Godongwana has defended the impending increase of the value-added tax (VAT) from 15% to 15.5%, scheduled for May 1, against legal challenges from the Democratic Alliance (DA) and Economic Freedom Fighters (EFF), asserting that the decision cannot be halted at this stage.

- Legal and Political Context: Godongwana argues that the DA’s application lacks merit and misinterprets Section 7(4) of the VAT Act, which allows for temporary adjustments to the VAT rate. He contends that this legal framework has been in place for over nine years without previous challenges, framing the current opposition as politically motivated rather than a genuine constitutional issue.

- Potential Consequences of Not Raising VAT: The Finance Minister warns that failing to implement the VAT increase would lead to severe consequences for state finances, potentially forcing the government to cut essential services like education and healthcare or increase borrowing, both of which pose significant risks to public welfare.

Source Moneyweb

Latest Posts in "South Africa"

- VAT Treatment of Municipal Supplies to National or Provincial Government in South Africa

- South Africa Proposes VAT Law Amendments to Implement E-Invoicing and Digital Reporting Framework

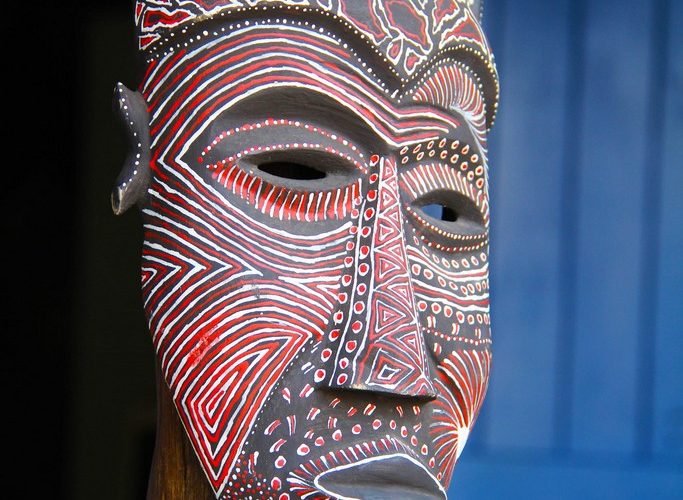

- Umkhonto Wesizwe Party Protests VAT Increase Ahead of Finance Minister’s Budget Speech in Pretoria

- South Africa’s Move to Mandatory E-Invoicing: Draft Law, Public Consultation, and Future Plans

- Briefing document & Podcast: South Africa’s E-Invoicing and Real-Time Reporting Overhaul