- Finance Minister Enoch Godogwana confirms VAT increase effective May 1

- VAT hike deemed necessary to prevent harm to state finances

- First 0.5 percentage point increase on May 1, 2025, second on April 1, 2026

- Government considered VAT as an efficient revenue source

- DA challenges VAT hike legality in court, citing financial impact on citizens

- DA’s court challenge focuses on Finance Committee procedure and constitutionality

- VAT increase causes tension within Government of National Unity

- FW de Klerk Foundation advises DA to stay in the GNU despite disagreements

Source: iol.co.za

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "South Africa"

- VAT Treatment of Municipal Supplies to National or Provincial Government in South Africa

- South Africa Proposes VAT Law Amendments to Implement E-Invoicing and Digital Reporting Framework

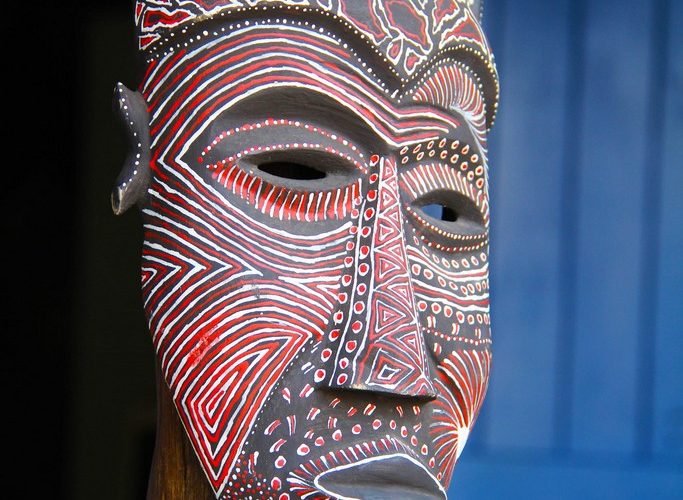

- Umkhonto Wesizwe Party Protests VAT Increase Ahead of Finance Minister’s Budget Speech in Pretoria

- South Africa’s Move to Mandatory E-Invoicing: Draft Law, Public Consultation, and Future Plans

- Briefing document & Podcast: South Africa’s E-Invoicing and Real-Time Reporting Overhaul