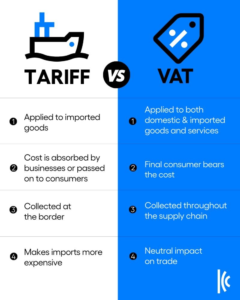

- Distinction Between VAT and Tariffs: The policy brief clarifies that value-added tax (VAT) operates as a consumption tax that is neutral and non-discriminatory, unlike tariffs, which are trade barriers that can favor domestic over foreign businesses.

- Mechanism of VAT: VAT is collected at multiple stages throughout the supply chain, with businesses responsible for collecting and remitting the tax, ultimately passing the cost to the final consumer, ensuring a fair competitive environment for all businesses.

- Principle of VAT Neutrality: VAT is designed to be neutral, taxing goods in the country of consumption rather than production, which prevents it from acting as a trade tariff and ensures that all products in the same market are treated equally regarding tax obligations.

Go directly to Download

Source ccwbo.org

Latest Posts in "World"

- VATupdate Newsletter Week 51 2025

- 40 Country Profiles on E-Invoicing, E-Reporting, E-Transport, SAF-T Mandates, and ViDA Initiatives

- 26 VAT changes coming in January 2026

- SAP Data Archiving: Everything You Need to Know – Benefits, Processes, and More!

- Self-Billing via Peppol: Streamlining Invoicing and Compliance for Belgian Businesses and Organizations