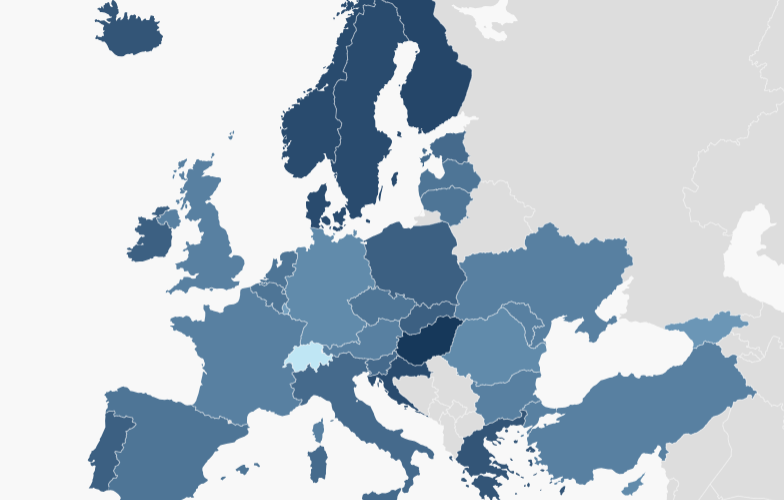

- Global VAT Landscape: Over 175 countries, including all major European nations, implement a Value-Added Tax (VAT) on goods and services, with EU Member States exhibiting varying VAT rates, harmonized to some extent by EU regulations.

- Recent Changes and Trends: Significant adjustments to VAT rates are occurring, such as Estonia’s planned increase to 24%, Finland’s rise to 25.5%, and Slovakia’s increase from 20% to 23%, alongside the abolition of exemptions and temporary reductions in several countries.

- Policy Implications and Recommendations: While reduced VAT rates aim to promote equity and support lower-income households, evidence suggests they can lead to inefficiencies and regressive impacts; the OECD recommends direct income support measures over VAT reductions to effectively address equity concerns.

Source