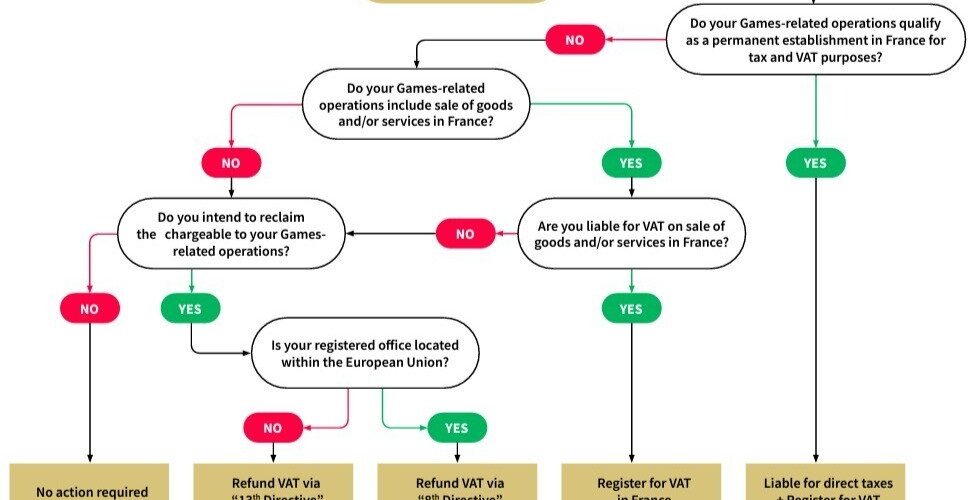

With the 2024 Olympics and Paralympics in France, non-French businesses involved in operations, sponsorship, or event attendance may have direct and indirect tax obligations, including potential VAT recovery. Specific guidance from the French Tax Authority advises on permanent establishment, corporate tax, personal income tax, and VAT requirements based on the nature of operations and residence. Essentia can assist in reviewing the business activities to determine VAT registration and recovery.

Source Essentia

Latest Posts in "France"

- Training ‘Holding: Facilitator & VAT’ (Nov 18)

- France Ends VAT Simplification, Requires Direct Registration for Non-EU Importers

- France Approves Digital Services Tax Hike to 15% for Large Tech Platforms

- France Updates VAT-Exempt Goods Lists for Guadeloupe, Martinique, and Réunion Effective March 2025

- France Proposes Raising Digital Services Tax to 15%, Sparking US Retaliation Threats