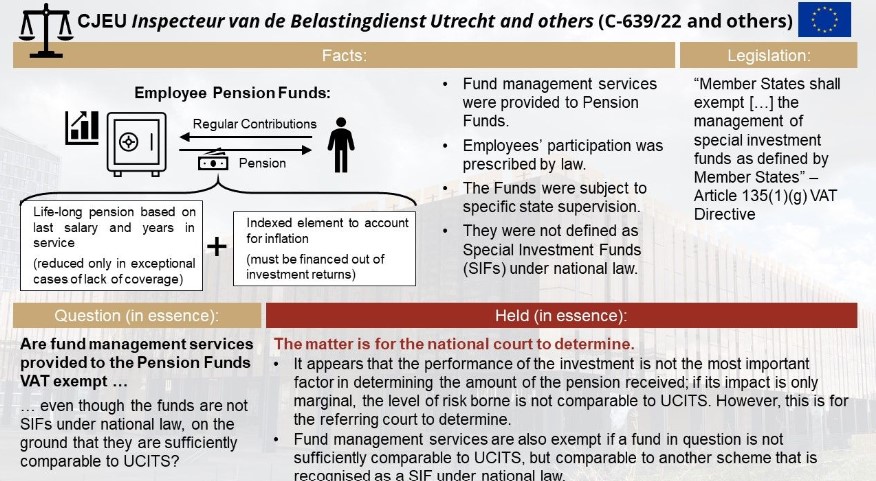

The CJEU’s task is to provide guidance on the interpretation of EU law, not to apply it to the facts of a case. When assessing UCITS-comparability, the risk borne by investors is the critical factor. If a fund is non-UCITS-comparable, it is sufficient to find a comparable fund recognized as a SIF under national law, and Article 135(1)(g) can have direct effect to achieve the exemption.

Sources

- Fabian Barth

- Taxlive – CJEU answers preliminary questions on VAT exemption for sectoral pension funds

- KPMG – Pension funds possibly special investment funds

- Taxence

See also

- ECJ C-639/22 & others – Judgment – Interpretation of VAT exemption for pension funds

- Roadtrip through ECJ Cases – Focus on Exemption – Management of special investment funds (Art. 135(1)(g))

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- VAT IOSS Scheme: Intermediary Registration Available from April 2026 for Non-EU Businesses

- Customs and VAT Fraud Cost EU €45 Billion in 2025, Officials Warn

- EPPO Investigates Record 3,600 Customs Fraud Cases in 2025, Damages Reach 67 Billion Euros

- Intermediary Registration for UK Import One Stop Shop Scheme Opens April 2026

- EPPO Uncovers €45 Billion VAT and Customs Fraud, Reshaping EU Criminal Landscape in 2025