- Taxpayer registered for GST and carries on taxable activity

- Taxpayer is a registered charity and non-profit body

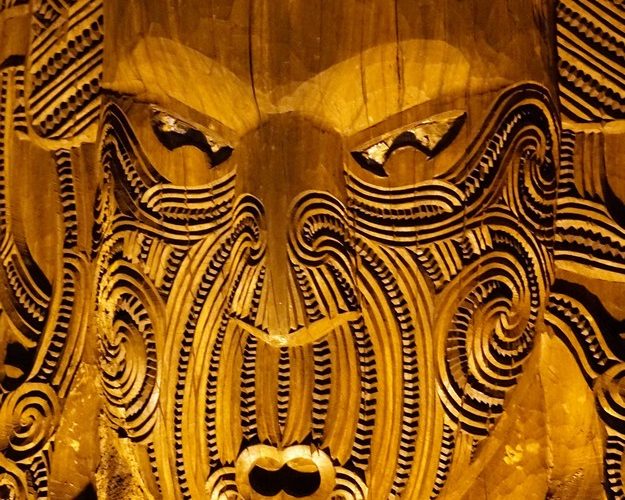

- Dispute over whether payments for participation in religious practices are subject to GST

- Taxpayer initially filed returns with GST included, later proposed adjustments which were rejected

- Dispute referred to Tax Counsel Office, which concluded Taxpayer was liable for GST on payments

- TCO considered reciprocity and direct benefits in determining if payments were subject to GST

- GST charged on supply of goods and services in course of taxable activity

- Definition of services includes anything not goods or money, religious practices fall under this definition

- No exception for services of religious nature in definition of services

Source: taxtechnical.ird.govt.nz

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "New Zealand"

- E-Invoicing in New Zealand: Key FAQs, Compliance Steps, and How ecosio Supports Your Journey

- New Zealand’s Phased E-Invoicing Rollout: Government-Led, Peppol Standard, Mandatory for Large Suppliers 2027

- New Zealand’s Phased E-Invoicing Rollout: Peppol Standard, Government-Led, Mandatory for Large B2G Suppliers 2027

- Briefing Document & Podcast: E-Invoicing and E-Reporting in New Zealand

- New Zealand GST Rules for Foreign Digital Service Providers and Online Marketplaces