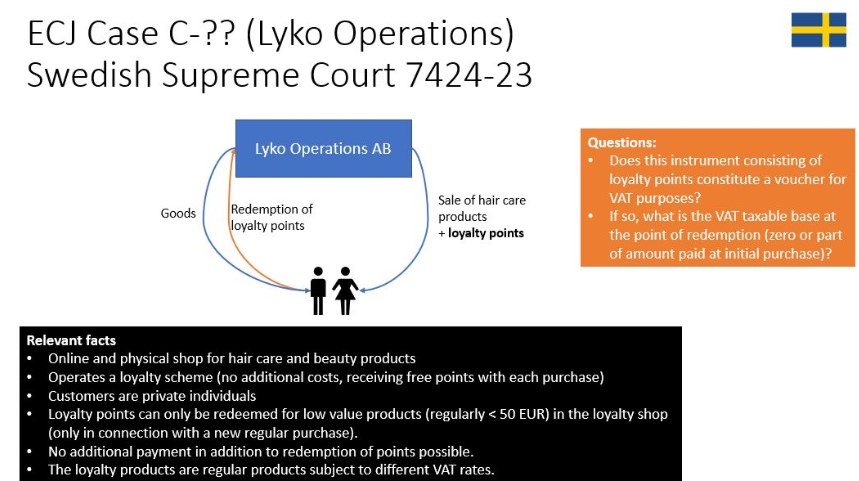

- The document discusses a court case regarding the classification of loyalty program points as vouchers for VAT purposes.

- The parties involved are Skatteverket (Swedish Tax Agency) and Lyko Operations AB.

- The main issue is whether the loyalty program points constitute vouchers according to the definition in the EU VAT Directive.

- The document outlines the arguments presented by both Skatteverket and Lyko Operations AB regarding the classification of the loyalty program points and the determination of the taxable amount when the points are redeemed.

- The Supreme Administrative Court seeks a preliminary ruling from the Court of Justice of the European Union to clarify the interpretation of the VAT Directive’s provisions in this case.

Source

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- Advocate General’s Opinion Clarifies VAT Treatment of Transfer Pricing Adjustments in Stellantis Portugal Case

- Agenda of the ECJ/General Court VAT cases -1 Judgment, 1 Hearing till Feb 25, 2026

- The «Prefilling» headache

- The Fiscalis Programme 2021–2027: Interim Evaluation and Key Insights

- EU ViDA E-Invoicing: Key Changes and Luxembourg Implications for Cross-Border B2B Transactions