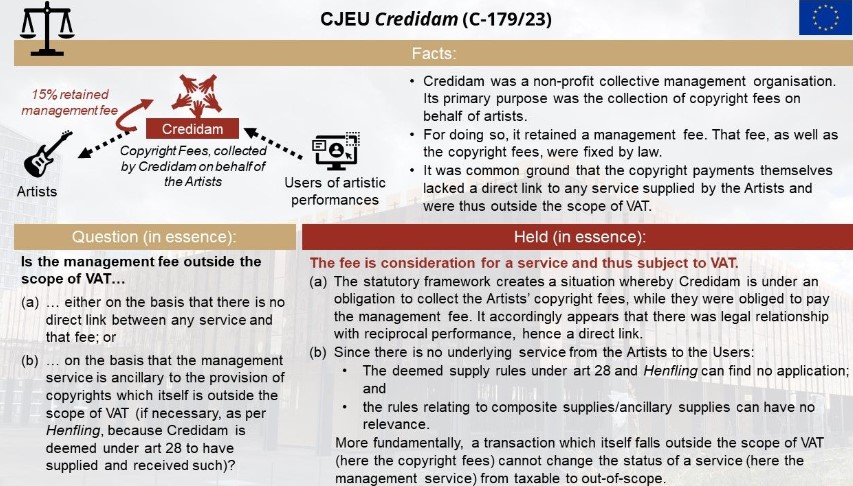

A great referral from Romania that significantly contributes to the development of EU VAT Law. Interesting is in particular the following point: once it is established that a transaction is inside the scope of VAT (as a supply of goods or services), it cannot fall outside thereof on the basis that it forms a single supply with an out-of-scope transaction. So, there can be for instance no supply ancillary to a TOGC. What the case itself leaves open is whether that also holds true the other way round, viz. whether something that is outside the scope of VAT cannot be brought into its scope by grouping it with an in-scope supply – but it would appear to be the result indeed if the principle is brought to its logical conclusion.

Source Fabian Barth

See also

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- ECJ VAT Cases decided in 2025

- ECJ C-475/24 (Fashion TV RO and Maestro) – Order – National courts must verify VAT compliance for deductions and may examine evidence

- EU and India conclude landmark Free Trade Agreement

- Comments on ECJ Case T-363/25: Hungarian Tax Authorities Cannot Deny VAT Deduction Solely for Unreliable Invoices

- Comments on ECJ C-796/23: Consideration of Czech company for VAT purposes as ‘designated partner’ in violation of EU law