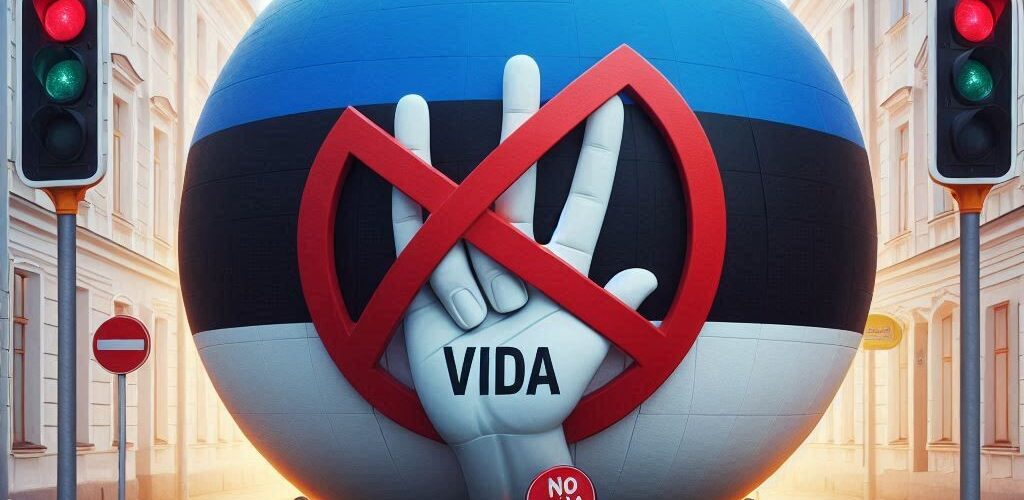

The ViDA initiative has not been agreed upon due to Estonia’s opposition to the proposed reform of VAT in the digital age. Estonia argues that the new regime would unfairly tax small and medium-sized businesses. The European Commission’s proposed measures include digital reporting requirements, addressing challenges of the platform economy, and reducing VAT registration requirements. The timeline for implementation remains unconfirmed, and Estonia has expressed concern about the platform economy pillar.

Source Edicom

Latest Posts in "European Union"

- MEPs Urge Simpler EU Tax Rules and Unified Tax ID to Boost Competitiveness

- European Parliament Debates Digital Services Tax Versus VAT Gap Solutions in Interparliamentary Meeting

- Applications Open for EU Member States to Host New EU Customs Authority

- ECHR: VAT Assessments in Italmoda Case Are Not Criminal Penalties Under Article 7 ECHR

- CFE Calls for Fundamental Reform of EU VAT Rules for Travel and Tourism Sector