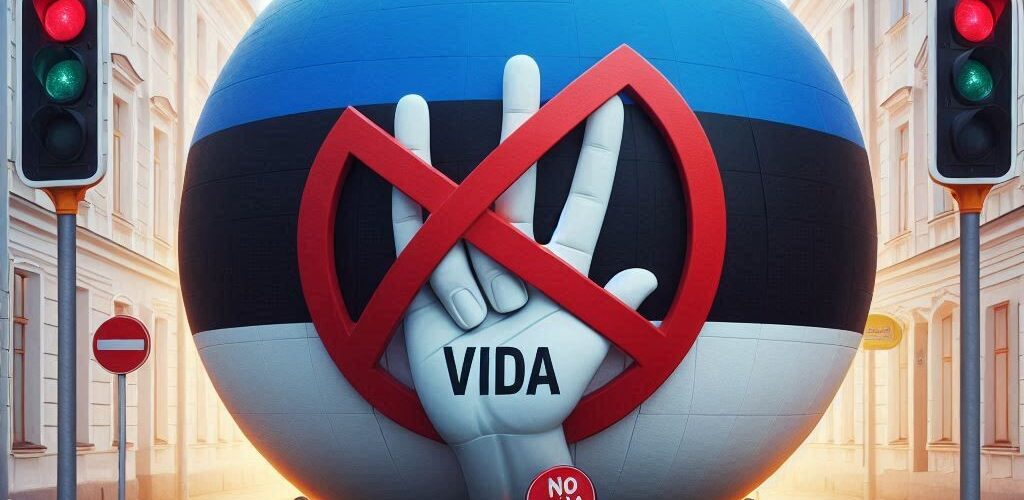

- Estonia opposes EU VAT reform targeting digital platforms

- Proposed reform would impose new liabilities on companies like Bolt Technology OU and Airbnb Inc.

- Estonian Finance Minister believes taxing services via digital platforms would burden SMEs and distort competition

- Estonia suggests a voluntary opt-in system instead of mandatory approach

- EU finance ministers failed to reach agreement on ViDA proposal in May

- Italy and Spain advocate for reform to collect more VAT revenues

- Bolt lobbying Estonian government to resist the measure

- Achieving unanimous agreement remains a challenge

- Belgium’s Finance Minister working on compromise to satisfy all member states

Source: globalvatcompliance.com

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

Latest Posts in "European Union"

- Roadtrip through ECJ Cases – Focus on ”Free Products” (Art. 16)

- Briefing document & Podcast: C-438/13 (BCR Leasing Case) – Relief for Leasing Firms Facing Asset Non-Recovery

- VAT Neutrality and Tax Fraud: Implications of Recent Jurisprudence

- Blog Luc Dhont: How Can Multinationals Comply with VAT on Transfer Pricing Adjustments Post-ECJ Arcomet?

- ECJ Opinion Sheds Light on VAT for Ancillary Services in German Accommodation Sector