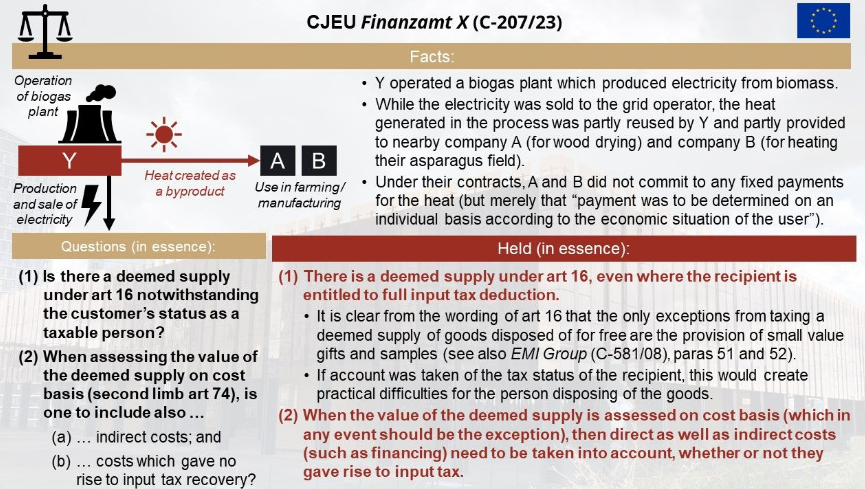

The VAT system includes taxable free supplies to prevent untaxed consumption, even when the recipient would be entitled to full input tax deduction. The judgment does not address whether the recipient could still recover input tax from the free supply. The Court’s finding that the tax base for a free supply includes elements without input tax deduction is less straightforward.

Source Fabian Barth

See also

- C-207/23 (Finanzamt X) – Judgment – Wood drying and heating as VAT base

- Roadtrip through ECJ Cases – Focus on ”Free Products” (Art. 16)

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- VATupdate.com – Your FREE source of information on ECJ VAT Cases

Latest Posts in "European Union"

- Roadtrip through ECJ Cases – Focus on ”Free Products” (Art. 16)

- Briefing document & Podcast: C-438/13 (BCR Leasing Case) – Relief for Leasing Firms Facing Asset Non-Recovery

- VAT Neutrality and Tax Fraud: Implications of Recent Jurisprudence

- Blog Luc Dhont: How Can Multinationals Comply with VAT on Transfer Pricing Adjustments Post-ECJ Arcomet?

- ECJ Opinion Sheds Light on VAT for Ancillary Services in German Accommodation Sector