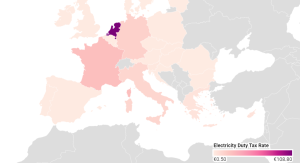

In 1999, the European Union implemented a harmonised excise duty on electricity to generate revenue for Member States and promote energy efficiency. However, current environmental policies, such as the EU Emissions Trading System, are more targeted at reducing carbon emissions. Despite this, the Energy Tax Directive still requires Member States to impose minimum electricity duty rates, with many imposing higher rates.

Source Taxfoundation

Latest Posts in "Europe"

- E-invoicing in Europe: how to navigate compliance in 2026-2027?

- Spanish Art World Protests 21% Cultural VAT, Demands Reduction to Match European Standards

- India IRN vs Europe CTC: Key Differences in E-Invoicing Models, Clearance, and Reporting

- RTC Webinar: The SAF-T Landscape: Country-Specific Requirements & Best Practices in Europe (Feb 18)

- Key Features and Practical Details of European VAT Systems in 2026