Confirmation from Dutch Tax Authorities: Simplified Triangulation for VAT Also Applies with Fourth Party in Same Country as Third Party

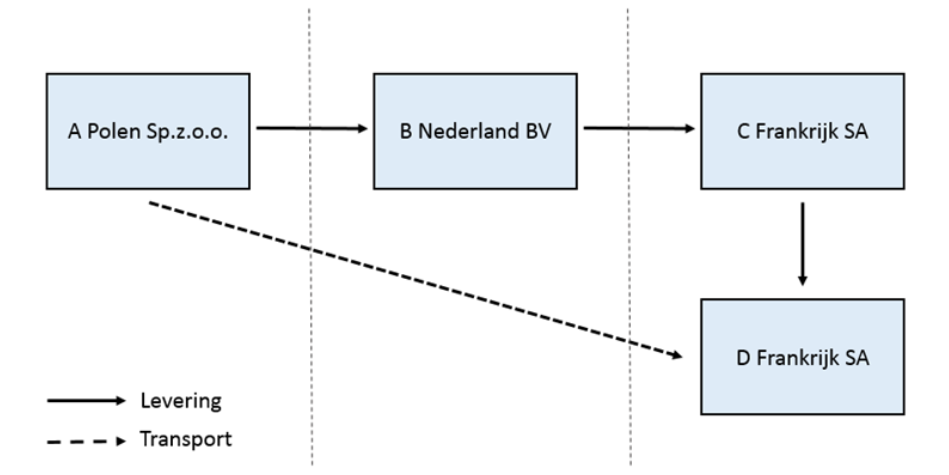

- On 1 January 2020, companies A, B, C, and D were involved in a chain of successive supply of goods.

- A delivers goods to B, who then delivers the same goods to C, and C subsequently delivers the same goods to D.

- The goods are transported directly from Poland to the business address of D in France on behalf of B. Company B, registered in the Netherlands for VAT purposes, wishes to apply the simplified ABC arrangement under Article 141 of the VAT Directive to ensure that the acquisition by B is not subject to Dutch VAT due to a so-called number acquisition.

- The simplified ABC arrangement is applicable to the chain of successive supplies from A to B and then from B to C, unless party C informs party B that France does not apply this simplification.

Source Belastingsdienst

Latest Posts in "Netherlands"

- VAT refund rightly refused due to unproven previous payment

- VAT Rules for Unpaid Invoices: When Can Entrepreneurs Reclaim or Repay VAT?

- No VAT Refund for X: Failure to Prove VAT Payment on Uncollectible Claim; Appeal Dismissed

- Netherlands Changes VAT Refund Procedure: Invoices Required from April 1, 2026

- Reduced VAT Rate Not Applicable to Artistic Murals, Only to Residential Painting and Plastering