- The legal period to request a refund of value-added tax is 5 years from the date of tax payment.

- If the request is not submitted before the end of the period, the tax cannot be refunded.

- To access supporting documents and FAQs regarding the procedures for VAT refund, visit the provided links.

Source: facebook.com

Note that this post was (partially) written with the help of AI. It is always useful to review the original source material, and where needed to obtain (local) advice from a specialist.

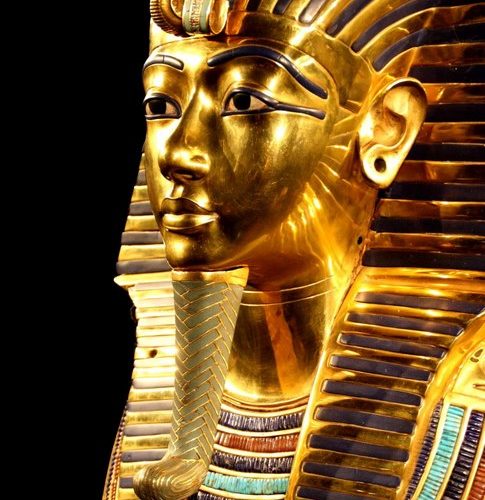

Latest Posts in "Egypt"

- Key Steps and Requirements for VAT Refund Requests in Egypt (2023 Update)

- No Paper Invoices Accepted for VAT Refund Requests from July 1, 2023, Says Tax Authority

- ‘Revised Rules’ Now Mandatory on Proofs of Origin for Exports from EU to Egypt Only

- Briefing document & Podcast: E-Invoicing & E-Reporting in Egypt

- Egypt Mandates Electronic Invoice Verification for Factoring Finance Under New FRA Regulations