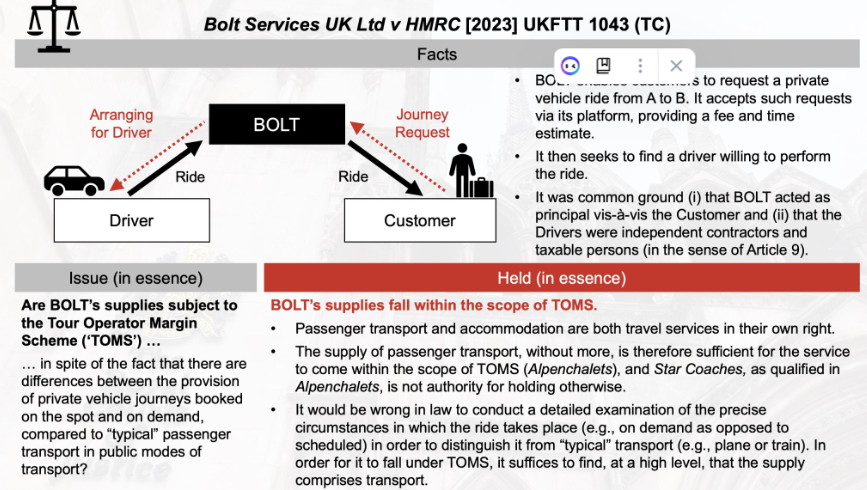

- The Tribunal has decided that the app BOLT’s services fall under the Tour Operator Margin Scheme (TOMS), despite HMRC’s initial position.

- The Court did not rely on the Uber decision for employment law.

- The Court’s case-law in Star Coaches was distinguished and may have been overruled in subsequent cases.

- Whether it is desirable for the supplies to be taxed at their margin is a policy question, not a legal one.

- The Tribunal considered post-Brexit CJEU case-law, despite the supplies occurring after Brexit.

Source Fabian Barth

Latest Posts in "United Kingdom"

- UK Supreme Court Rules Input VAT on Share Sale Professional Fees Irrecoverable for Holding Companies

- Isle of Man to Raise Plastic Packaging Tax Rate from April 2026

- Supreme Court Upholds VAT Restrictions on Share Sale Costs in Hotel La Tour Case

- UK VAT Gap Rises to £11.9bn in 2024/25, Up from £8.9bn Last Year

- Change in the VAT treatment of supplies of locum medical practitioners