The Italian Revenue Agency has issued a Provision for the implementation of new reporting and exchange of information requirements related to income generated by sellers on digital platforms (DAC7). This is in response to issues arising from unreported income and tax evasion on digital platforms operating across multiple countries. DAC7 mandates digital platform operators to report seller income and for EU Member States to exchange this information. The first reporting is due by 31 January 2024 and the first exchange of information by 29 February 2024.

Source Orbitax

Latest Posts in "Italy"

- Faster VAT Collection: 2026 Budget Law Introduces Automated Assessment for Omitted Declarations

- New 2026 VAT Forms Approved: Changes to Deduction Adjustment Calculation Included

- Approval of 2026 VAT Return Forms and Instructions for 2025 Tax Year Submission

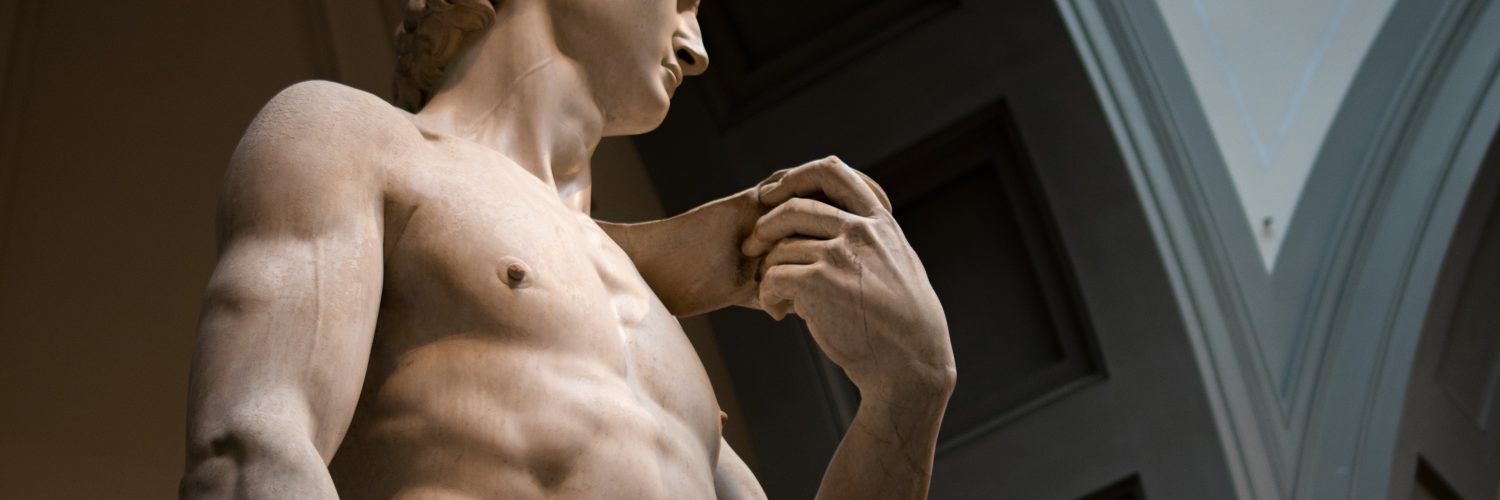

- Foundry Services for Commissioned Artworks Subject to 22% VAT, Not 5% Reduced Rate

- Applicable VAT Rate for Art Foundry Services: 5% or 22% for Commissioned Contemporary Artworks?