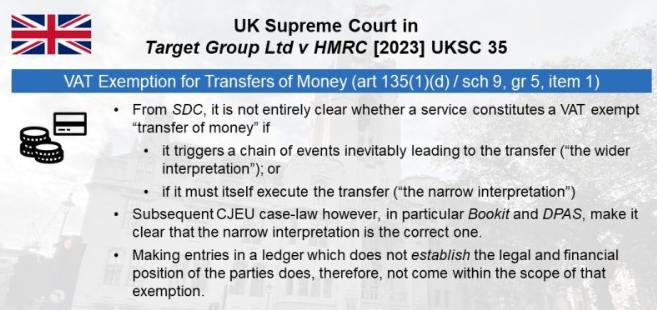

The VAT exemption for transfers of money requires the service to comprise the actual effecting of a transfer of legal title in the funds. It is not sufficient if it sets off a chain of events inevitably and automatically leading to the transfer. This interpretation by the UK Supreme Court of the CJEU’s case-law is perhaps beyond reproach – but it does render the exemption painfully narrow, and leads to services being taxed that are integral to the overall transfer and, from a consumer’s perspective, just as indistinguishable. As I have argued in my paper before, this might be an area where the post-Brexit UK can consider legislative intervention.

Source Fabian Barth

See also

Latest Posts in "United Kingdom"

- Key VAT Updates 2025: Recovery, Grants, Exemptions, CGS Changes, and Care Home Structuring

- HMRC Introduces New Customs Data Reporting Service for Importers, Exporters, and Third Parties

- Top 10 Essential VAT Tips for Small Businesses and Start-Ups

- UK Abolishes TOMS VAT Loophole for Taxis; 20% VAT on Full Fare from 2026

- FTT Rules Maintenance Services to Lessors Are Standard-Rated, Not Exempt, for VAT Purposes