- The European Union (EU) dominates the cigarette market with taxes, which include a fixed amount per pack and a percentage of the retail price.

- The minimum excise tax rate is €1.80 per pack and must be at least 60% of the weighted average retail selling price.

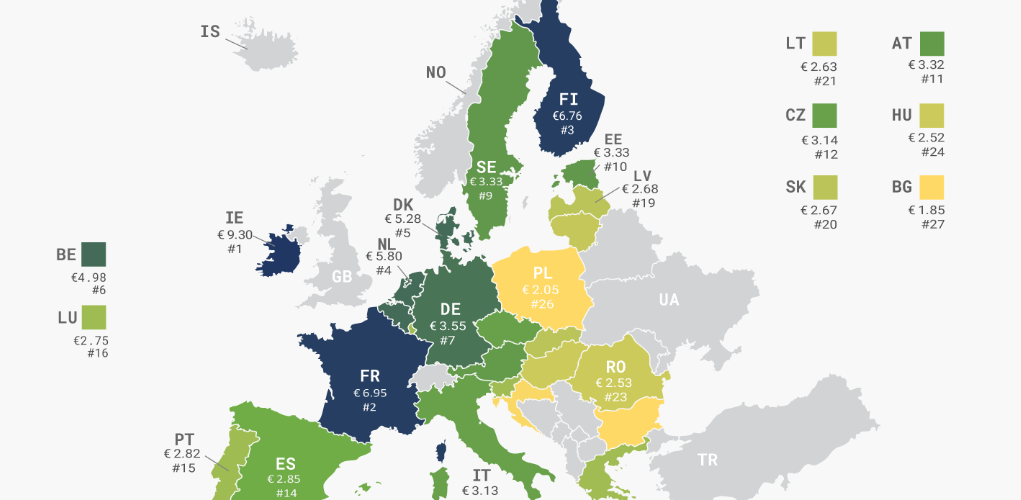

- Most countries levy higher rates. In 2023, the average tax-induced price increase exceeded 450%. Taxes vary across EU member states, with Ireland having the highest tax at €9.30 per pack and Bulgaria having the lowest at €1.85.

- Research shows that cigarette taxes are regressive and fuel global cigarette smuggling.

- KPMG estimates that over 30 billion counterfeit and contraband cigarettes were consumed in the EU in 2020, representing a loss of €8.5 billion in tax revenue.

- An update to the EU Tobacco Tax Directive is being considered, which could have a major impact on well-being in the EU.

Source Tax Foundation