Updated July 7, 2023

Highlights June 2023

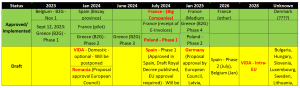

- France and Poland will implement mandatory E-Invoicing and Real Time Reporting per July 1, 2024

- On June 23, 2023, the European Commission issued a Proposal for a Council Implementing Decision authorising Germany to introduce E-Invoicing and Real Time Reporting as of Jan 1, 2025

- On June 23, 2023, the European Commission issued a Proposal for a Council Implementing Decision authorising Romania to introduce E-Invoicing and Real Time Reporting as of Jan 1, 2024

- On June 15, 2023, Spain issued a Draft Royal Decree to implement mandatory E-Invoicing. It is open for public consultation till July 10, 2023, The planned implementation date, which was set at July 1, 2024, will be postponed. Spain does not have the approval yet from the European Commission t implement mandatory B2B E-Invoicing.

- On June 16, 2023, an ECOFIN (Minsters of Finance of the Member States) meeting took place on June – Find out what the countries think about ViDA

- On June 20, 2023, the European Parliament issued a draft report on ViDA and suggested 251 (!!) changes

Country updates

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

See also

- Worldwide Upcoming E-Invoicing mandates, implementations and changes – Chronological

- Upcoming E-Invoicing & E-Reporting mandates in the European Union (incl. ViDA)

Latest Posts in "European Union"

- EDPS Opinion on EPPO and OLAF Access to VAT Data for Combating EU Fraud

- EU Agrees on Temporary €3 Customs Duty for Low-Value E-Commerce Parcels from July 2026

- New InfoCuria case-law database and search tool

- New General Court VAT case – C-903/25 (Grotta Nuova) – No details known yet

- New General Court VAT case – C-914/25 (Modelo Continente Hipermercados) – No details known yet