- Expenses invoice, paid by employees (excluding purchase card or corporate card), with invoice (e-invoicing) or without invoice (e-reporting of transaction

data without invoice). - This management case covers expenses incurred by employees in the course of their professional activity.

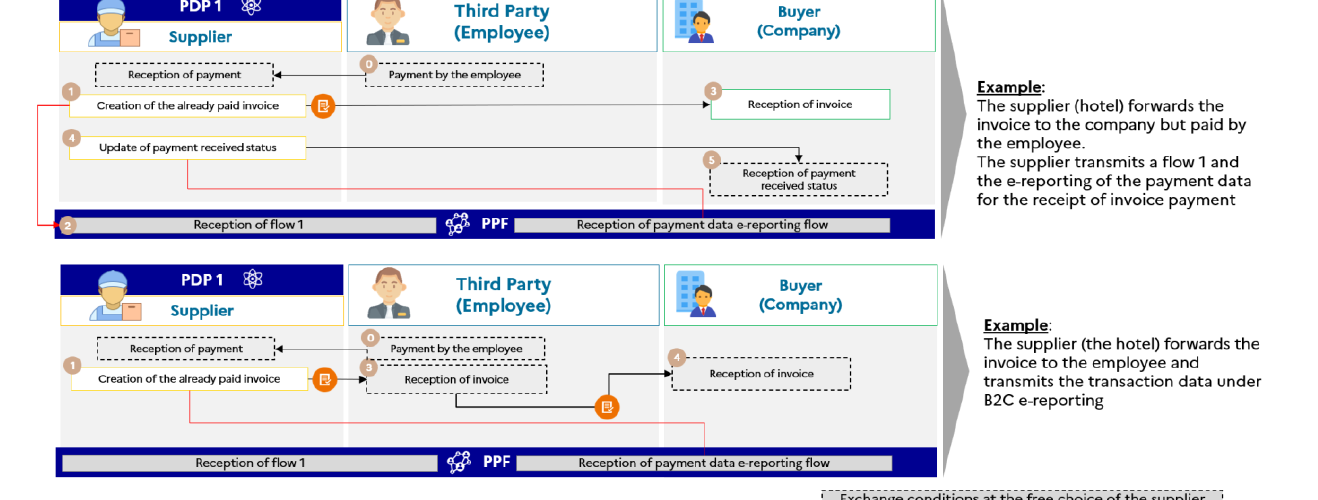

Case 1: Invoice is addressed to the company, but paid by the employee

- In this case, the employees incur the expenses and the company reimburses them. This is only valid if the invoice paid by the employee is in the name of the company. The employees are then considered as third-party payers.

Case 2: Invoice is NOT in the name of the company and paid by the employee

- In the case of an invoice paid by the employee which is not in the name of the company, this invoice must be declared by the supplier as B2C, and is therefore subject to e-reporting.

- It is therefore not declared under B2B and is not subject to an electronic invoice.

Source impots.gouv.fr (Page 39 – Case no 5 & 6)

Join the Linkedin Group on Global E-Invoicing/E-Reporting/SAF-T Developments, click HERE