Economic Community of West African States (ECOWAS) has decried the low contribution of Value Added Tax (VAT) to Nigeria’s tax revenue, blaming the development on policy decisions and compliance rate.

ECOWAS Director of Customs Union and Taxation, Salifou Tiemtore, made the submission yesterday in Abuja at a workshop on production of VAT expenditure for Nigeria, organised by ECOWAS Commission under the context of implementation of support Programme for Tax Transition in West Africa (PATF).

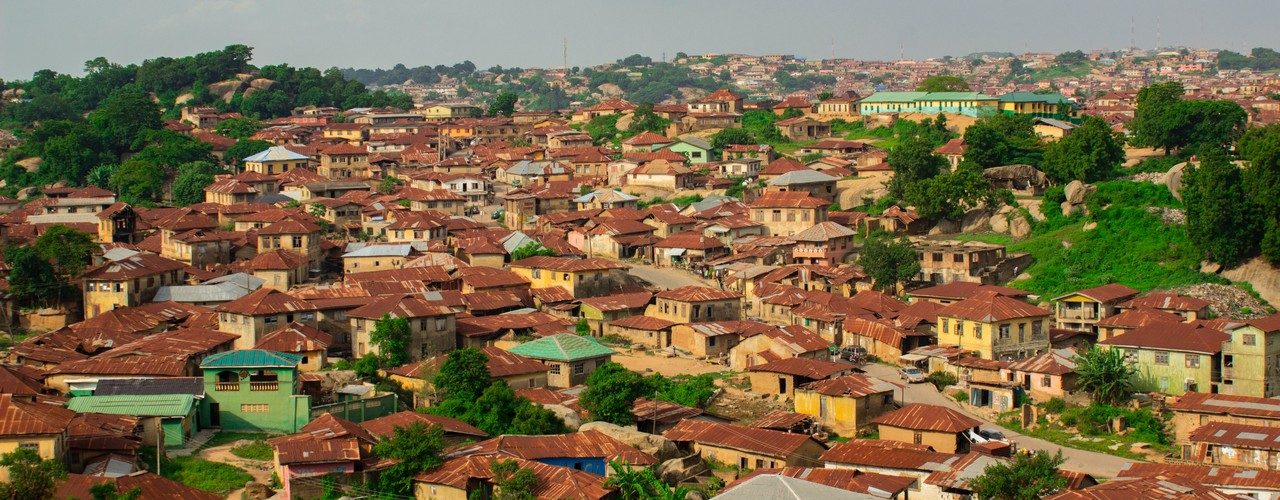

Source: guardian.ng

Latest Posts in "Nigeria"

- Nigeria Sets E-Invoicing Compliance Deadlines: Phased Rollout Begins April 2026 for Large Taxpayers

- NCAA Orders Overland Airways to Refund Passengers Wrongly Charged VAT Before January 2026

- Nigeria Sets E-Invoicing Rollout Dates for Medium and Emerging Taxpayers Through 2028

- Nigeria Expands E-Invoicing System to Medium and Emerging Taxpayers with Phased Rollout Timelines

- Nigeria Sets Timeline for E-Invoicing and Electronic Fiscal System Rollout by Taxpayer Category