What is the standard VAT rate?

The standard VAT rate is the default rate of Value Added Tax (VAT) that is applied to most goods and services in a particular country.

What is the effective VAT rate?

The effective rate is the ratio of the VTTL (VAT Total Tax Liability) and the tax base.

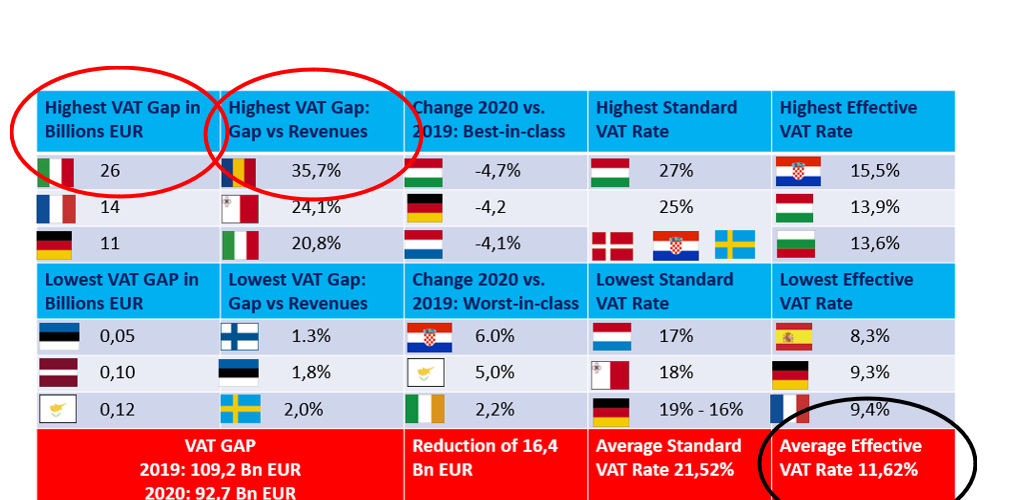

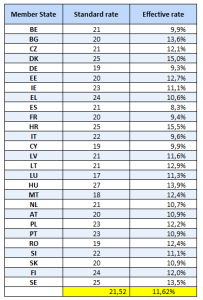

In 2020, the average standard VAT rate in the European Union was 21, 52%, while the effective rate is 11, 62%. The difference is due amongst other to the reduced VAT rates and exemptions for certain goods and services.

Source VAT Gap: EU countries lost €93 billion in VAT revenues in 2020

Latest Posts in "European Union"

- VAT Liability of Assignee Persists Even if Assignor Ceases to Exist, EU Court Rules

- Can Businesses Recover VAT if Supplier’s VAT Number Is Revoked? Key Insights from Latest ECJ Case

- GENA Submits Six Recommendations to EC on Harmonising E-Invoicing in Public Procurement

- Boost your knowledge of EU’s VAT in the Digital Age (ViDA)

- Comments on ECJ Case C-121/24: Ruling on Joint VAT Liability When Main Debtor Loses Legal Status: Key Issues Analyzed