Source Fabian Barth

See also

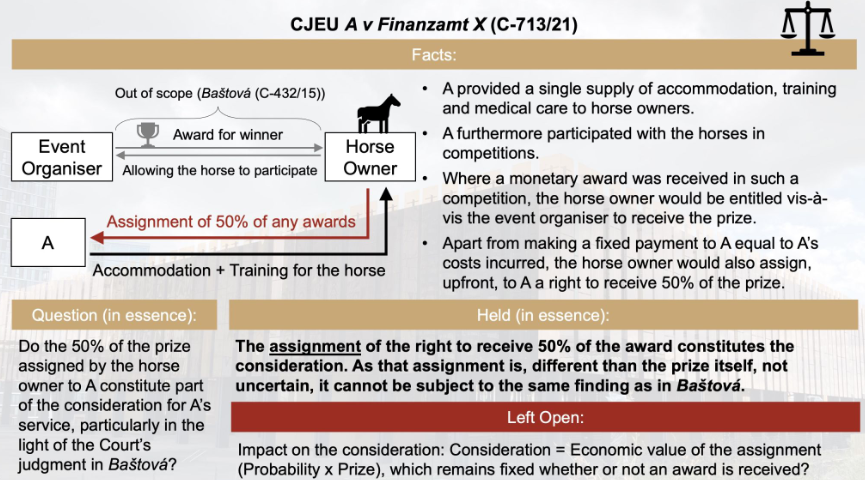

- C-713/21 (Finanzamt X) – Judgment – Composite supply by owner of a competition horse training stable?

- C-432/15 (Pavlína Baštová) – Prize money is not a Taxable Transaction for VAT purposes

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- For an overview of ECJ cases per article of the EU VAT Directive, click HERE

Latest Posts in "European Union"

- Questions to ECJ – Quick Fixes Under Scrutiny: Is an EU VAT ID a Substantive Requirement for Zero-Rating?

- Briefing document & Podcast: ECJ VAT C-622/23 (RHTB) – VAT Implications in Work Contract Cancellations

- New GC VAT Case: C-689/25 (British Company) – No details known yet

- Comments on ECJ Case C-726/23 (Arcomet) – ECJ clarifies VAT rules for Transfer Pricing adjustments in intragroup transactions

- ETAF Calls for Modern, Harmonised VAT Rules for EU Travel and Tourism Sector Reform