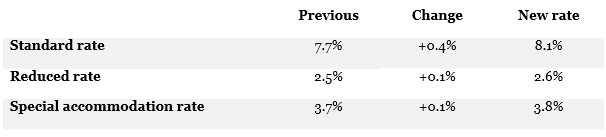

To cover an expected deficit in the AHV state pension scheme, Swiss VAT rates will increase as follows:

The increase in VAT rates will take effect on 1 January 2024. We expect the FTA to publish guidance on its website before the new VAT rates come into force, explaining how the new rates are to be applied to supplies and invoices spanning the changeover period.

Source Mihaela Merz

Latest Posts in "Switzerland"

- Federal Court Upholds Mini Cucumber Tariff, Dismisses Appeal on “Cucumber Snack” Imports

- Swiss Court Rules Cornea Imports Not VAT-Exempt; Full Invoice Amount Subject to Import Tax

- Guidelines for Foreign VAT Refunds When Bringing Goods into Switzerland for Private Individuals

- Draft VAT Practice Adjustments for Plant Protection Products Effective December 2025

- Switzerland Proposes Temporary VAT Hike to Fund Military Modernization Amid Security Concerns