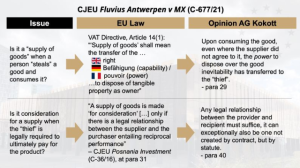

Although prima facie on the edges of the VAT system, the case Fluvius Antwerpen before the CJEU raises interesting questions on two fundamental concepts in VAT, namely: What constitutes a supply of goods, and what constitutes consideration in return for it?

Source Fabian Barth

See also ECJ C-677/21 (Fluvius Antwerpen) – AG Opinion – Unlawful use of energy a supply of goods

- Join the Linkedin Group on ECJ VAT Cases, click HERE

- For an overview of ECJ cases per article of the EU VAT Directive, click HERE

Latest Posts in "European Union"

- Maximizing VAT Recovery: Essential Tips for Businesses

- EU Announces VAT Digital Age Implementation Strategy to Combat Fraud and Modernize System

- ECJ Rules on VAT Treatment of Mobile App Services Before 2015

- EPPO Indicts 36 Suspects in €24.3 Million VAT Fraud Scheme

- EU Court Rules on VAT Liability for App Store Digital Platform Sales