You usually do not have to calculate VAT on subsidies, compensation and voluntary contributions. The amount you receive is not a direct payment for your work. Is there a direct link between these payments and your work? Then you do calculate VAT.

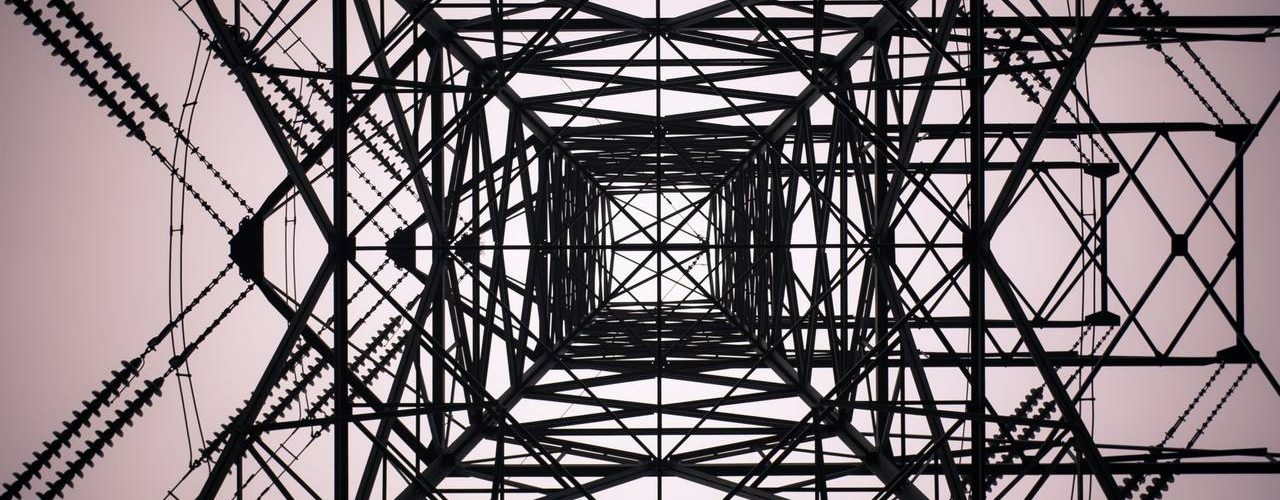

Will you receive € 190 in energy compensation in November and December 2022 due to the temporary price cap bridging scheme? This is regarded as an untaxed subsidy for VAT purposes. This means that you do not have to pay VAT on this.

Source: belastingdienst.nl

Latest Posts in "Netherlands"

- Despite major renovation of the hotel, there is no question of essentially new construction

- Partial VAT Deduction for Home Construction with Integrated Solar Panels Based on Actual Use

- Supreme Court Overturns VAT Penalty Ruling: Key Inspector’s Argument Ignored, Case Referred Back

- New General Court VAT case T-851/25 (Roenes) – No details known yet

- Dutch Tax Authority Loses €1.5 Billion to Vanishing Entrepreneurs via Turbo Liquidations