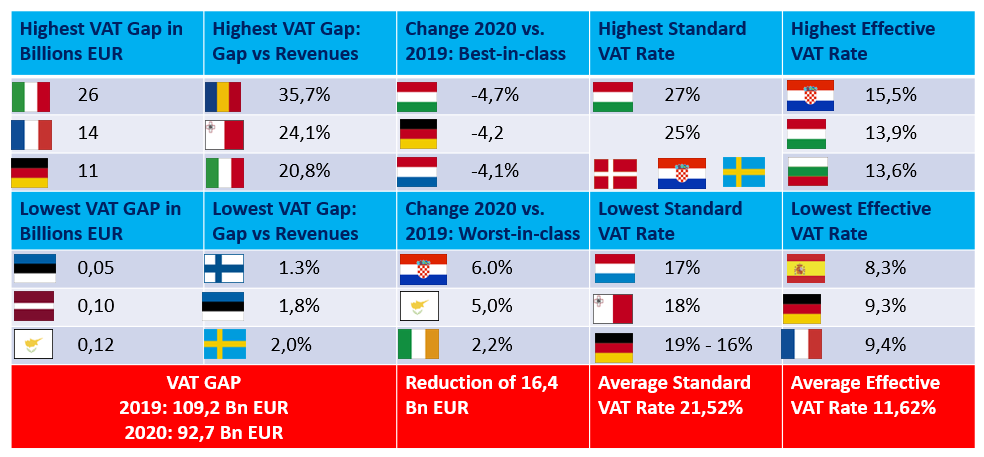

EU Member States lost an estimated €93 billion in Value-Added Tax (VAT) revenues in 2020, according to the 2022 Report on the VAT Gap released by the European Commission. Though still extremely high, the ‘VAT Gap’ – the estimated difference between expected revenues in EU Member States and the revenues actually collected – dropped by approximately €31 billion compared to the 2019 figures. This increase in VAT compliance can be explained to some extent by the effect of government support measures introduced in response to the COVID-19 pandemic, which were contingent on paying taxes. However, the VAT Gap clearly remains an important problem, at a time when governments need sustainable revenues to help weather today’s economic uncertainty.

Source Taxation-customs.ec.europa.eu

Latest Posts in "European Union"

- Comments on ECJ C-101/24 (Xyrality) – Judgment on app stores as VAT commissionaires

- ECJ Confirms Deemed Reseller Rule for App Store In-App Purchases

- VAT Challenges in Toll Manufacturing: Goods vs Services Classification Issues

- VAT and Transfer Pricing – Four recent cases @ ECJ/CJEU – 3 cases decided, 1 case pending

- Briefing document & Podcast: ECJ C-580/16 (Hans Bühler) – Late submission of recapitulative statements should not disqualify a business from exemptions