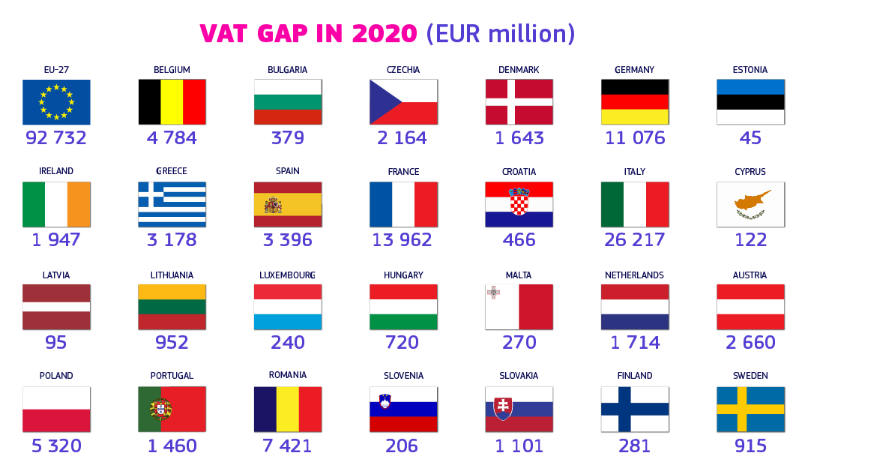

EU Member States lost an estimated €93 billion in Value-Added Tax (VAT) revenues in 2020, according to the 2022 Report on the VAT Gap released by the European Commission. Though still extremely high, the ‘VAT Gap’ – the estimated difference between expected revenues in EU Member States and the revenues actually collected – dropped by approximately €31 billion compared to the 2019 figures. This increase in VAT compliance can be explained to some extent by the effect of government support measures introduced in response to the COVID-19 pandemic, which were contingent on paying taxes. However, the VAT Gap clearly remains an important problem, at a time when governments need sustainable revenues to help weather today’s economic uncertainty.

Source Taxation-customs.ec.europa.eu

Latest Posts in "European Union"

- CJ Rules on Customs Valuation for Imports with Provisional Prices: Tauritus Case (C-782/23)

- EDPS Opinion on EPPO and OLAF Access to VAT Data for Combating EU Fraud

- EU Agrees on Temporary €3 Customs Duty for Low-Value E-Commerce Parcels from July 2026

- New InfoCuria case-law database and search tool

- New General Court VAT case – C-903/25 (Grotta Nuova) – No details known yet