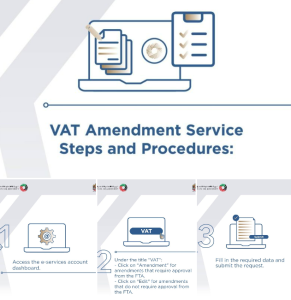

To apply for VAT Amendment, make sure to follow the steps and procedures mentioned in the post

Latest Posts in "United Arab Emirates"

- Declaration of Tax Group Eligibility and Compliance Summary

- Key Highlights of Ministerial Decision No. 243 & 244 of 2025 on Electronic Invoicing

- UAE e-Invoicing 2025: Key Rules, Timelines, and Actions for Businesses Under MD 243 & 244

- Federal Tax Authority Revises Turnover Declaration Rules for VAT Group Registrations

- UAE E-Invoicing: Digital Transformation, Compliance, and Efficiency for Micro Enterprises and Businesses