The European Commission provided an update on e-invoicing at the OpenPeppol general meeting in Brussels on November 3, 2022. Interesting different perspectives from various different departments – including policy (DG Grow), the systems side (DG DIGIT) and high level overview of the tax legislative proposals under VAT in the Digital Age (DG TAXUD).

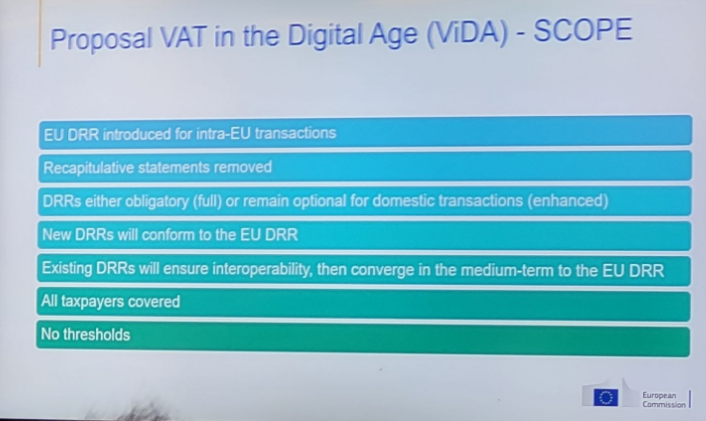

The European Commission will issue on December 7, 2022 its proposal on VAT in the Digital Age, which will include a proposal on Digital Reporting Requirements (DRR). We published a series of newsitems to bring you up-to-speed, click HERE

Posts on Linkedin

- Ellen Cortvriend – ”moving towards an intra-EU reporting system based on the European Norm”

- Axel Baulf – ”a single new cross-border requirement leveraging the European e-invoicing standard (EN 16931)”

- Thierry Amadieu – ”DGTaxud will implement DRR as mandatory interoperability framework for eReporting of intra EU transactions aiming to a convergence at mid term”

Latest Posts in "European Union"

- ECG T-96/26 (TellusTax Advisory) – Questions – VAT deductions in the event of different VAT treatment between Member States

- VIDA Measures applicable from 1 January 2027

- Agenda of the ECJ/General Court VAT cases – 7 Judgments and 2 Hearings till March 25, 2026

- Comments on T-638/24: Double dip alert – an incorrect invoice can create multiple VAT liabilities

- VAT IOSS Scheme: Intermediary Registration Available from April 2026 for Non-EU Businesses