The new system, which will be enforced from April 1, 2023, will include changes to terminology, rules, and documentation requirements.

The use of tax invoices will be replaced by a more general requirement to provide and keep certain records known as ‘taxable supply information,’ and the customer will not be required to maintain a single physical document holding the taxable supply information, such as a tax invoice, credit note, and debit note.

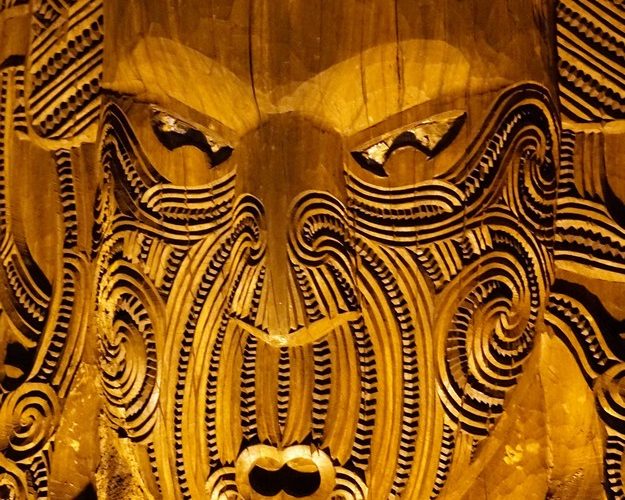

Source: indiannewslink.co.nz

Latest Posts in "New Zealand"

- E-Invoicing in New Zealand: Key FAQs, Compliance Steps, and How ecosio Supports Your Journey

- New Zealand’s Phased E-Invoicing Rollout: Government-Led, Peppol Standard, Mandatory for Large Suppliers 2027

- New Zealand’s Phased E-Invoicing Rollout: Peppol Standard, Government-Led, Mandatory for Large B2G Suppliers 2027

- Briefing Document & Podcast: E-Invoicing and E-Reporting in New Zealand

- New Zealand GST Rules for Foreign Digital Service Providers and Online Marketplaces