The applicant company performs a series of services essentially attributable to the selection and consequent approval of one or more investment opportunities on behalf of the investors, for which it receives a consideration calculated as a percentage of the purchase price of the NPL object of investment.

The Revenue Agency limits itself to reporting basic assessments in relation to the classification of the case represented, for the purpose of the VAT exemption and refers to case C-2/95 which explains that such transactions are exempt if they form “ancillary” services if they process the specific and essential functions of a payment (or, in any case, of a financial transaction), resulting in changes financial relationships.

Sources:

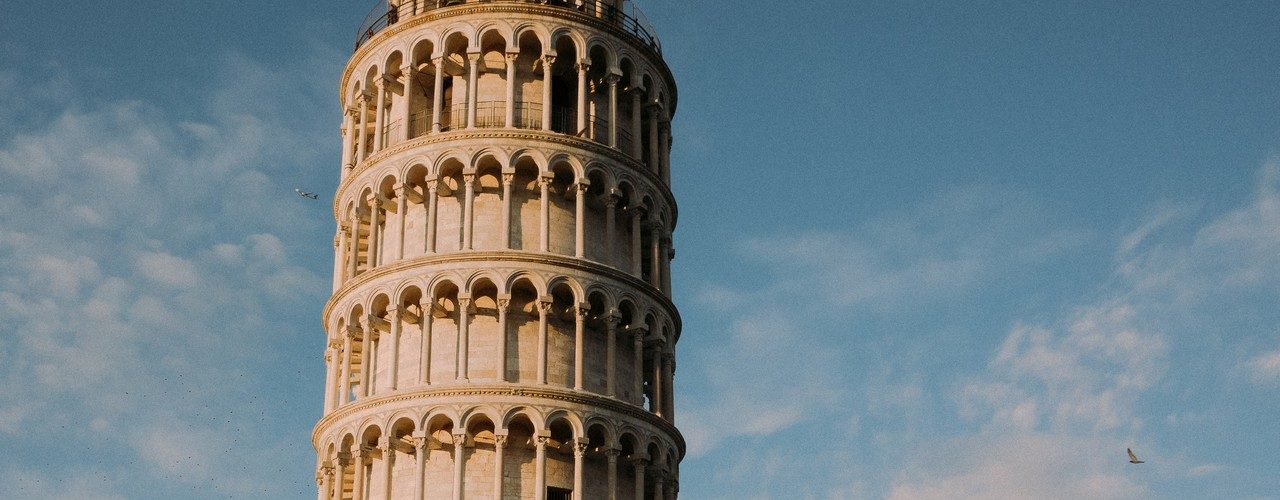

Latest Posts in "Italy"

- Naples Public Officials Convicted in Major Cross-Border VAT Fraud Case

- Italy: Officials, Tax Officer, and Accountant Convicted for Major VAT Fraud Scheme

- Italy: Four Convicted, Seven Plead Guilty in Major VAT Fraud Involving Public Officials

- Italy introduces automated VAT assessment for omitted annual returns

- €3.6 Million VAT Evasion: Major Textile Smuggling Operation Busted in Prato, Italy