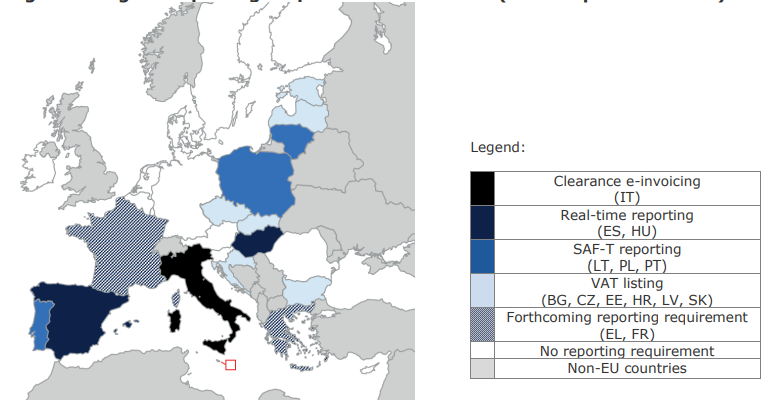

This part of the Study covers ‘Digital Reporting Requirements’, that is any obligation for VAT taxable persons to periodically or continuously submit data in a digital way on all (most of) their transactions, including by means of mandatory e-invoicing, to the tax authority. As of September 2021, 12 EU Member States have introduced a Digital Reporting Requirement, with positive net impacts, as the additional VAT revenue exceeds the costs for setting up the system and complying with the requirements. However, the existing rules (or lack thereof) on Digital Reporting Requirements generate two main problems: (i) a fragmented regulatory framework, and (ii) an insufficient degree of fight against VAT fraud, for intra-EU transactions, as well as at a domestic level. The analysis of impacts of possible policy options shows that the best policy choice results from the introduction of an EU Digital Reporting Requirement. As for the type of requirement, the comparison suggests that an e-invoicing solution ranks first across the various scenarios.

Link to the Report

Source op.europa.eu

Just one extract: Digital Reporting Requirements in the EU (as of September 2021)

Latest Posts in "European Union"

- ECG T-96/26 (TellusTax Advisory) – Questions – VAT deductions in the event of different VAT treatment between Member States

- VIDA Measures applicable from 1 January 2027

- Agenda of the ECJ/General Court VAT cases – 7 Judgments and 2 Hearings till March 25, 2026

- Comments on T-638/24: Double dip alert – an incorrect invoice can create multiple VAT liabilities

- VAT IOSS Scheme: Intermediary Registration Available from April 2026 for Non-EU Businesses