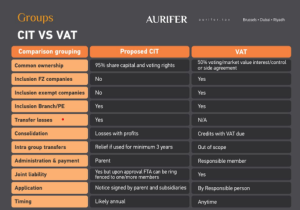

Definitely different concepts and consequences. A quick overview is below. For more details, and many more insights on the proposed corporate income tax regime in the UAE, tune in to our webinar tomorrow. The registration link is in the comments.

Why listen in you’ll say? The proposed regime is not expected to deviate much from the final one, it is therefore definitely worth analyzing the Ministry of Finance’s Public Consultation Document.

Source Thomas Vanhee /Aurifer

Latest Posts in "United Arab Emirates"

- UAE to Implement Key VAT Law Amendments from January 2026 to Enhance Tax Compliance

- UAE Announces Penalties for Non-Compliance with Mandatory E-Invoicing Starting July 2026

- UAE Amends VAT Law for 2026: Streamlined Compliance, Refund Limits, and Stronger Anti-Evasion Measures

- UAE Amends VAT Law to Enhance Transparency, Efficiency, and Strengthen Tax Compliance from 2026

- UAE to Amend VAT Rules from January 2026 to Simplify Tax Procedures and Boost Compliance