If you’re a US eCommerce seller, GST may not even be on your radar. We don’t blame you. With so many countries in the world implementing their own tax schemes, consumption taxes can get real complicated, real fast.

So here’s what you need to know. GST stands for “goods and services tax.” Like VAT, GST is typically charged at every stage of production. And like US sales tax, it’s typically levied as a flat-rate percentage, based on the value of the transaction.

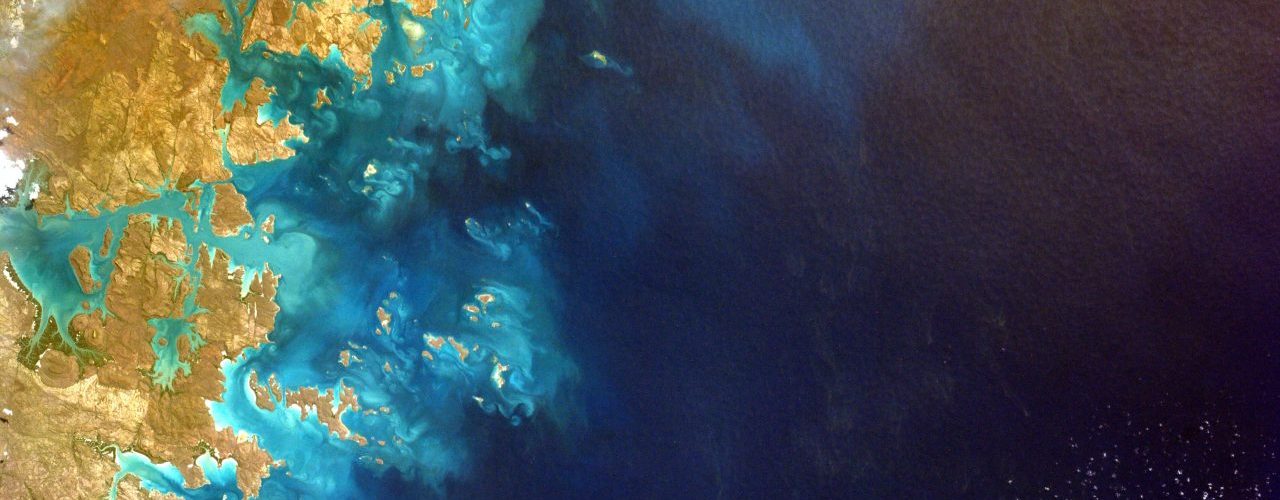

Source Quaderno

Latest Posts in "World"

- OECD Issues Guidance on Digital Continuous Transactional Reporting Regimes for VAT Compliance and Administration

- VATupdate Newsletter Week 2 2026

- Fintua’s International VAT Rate Round Up: December 2025

- E-Invoicing & E-Reporting developments in the news in week 2/2026

- OECD Guidance for Effective and Interoperable VAT E-Invoicing and E-Reporting Regimes