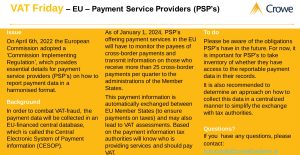

As of January 1, 2024, PSP’s offering payment services in the EU will have to monitor the payees of cross-border payments and transmit information to the administrations of the Member States.

This payment information is automatically exchanged between EU Member States and may also lead to VAT assessments.

Latest Posts in "European Union"

- CJEU Rules Loyalty Points Are Not Vouchers for VAT Purposes in Lyko Case

- EU to Publish First CBAM Certificate Price on 7 April 2026

- Roadtrip through ECJ cases: Focus on Promotional activities/Discounts (Art. 79, 87, 90(1))

- Briefing document & Podcast: Ibero Tours (C-300/12): VAT Principles Clarified on Price Reductions by Intermediaries

- Roadtrip through ECJ Cases – Focus on ”Vouchers” (Art. 30a, 30b, 73a)