Before you start

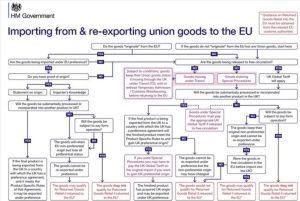

You may need to read the following guidance to use this tool:

- finding commodity codes for imports into or exports out of the UK

- check your goods meet the rules of origin

- detailed guidance on rules of origin for goods moving between the UK and EU

- how to claim preferential rates of duty between the UK and EU

- find out how to get proof of origin for your goods

- check how to move your goods to common or EU transit countries

- pay less or no duty on goods you store, repair, process or temporarily use

- check the tariffs on goods imported into the UK

- find out about the UK’s trade agreements

- how to pay less import duty and VAT when re-importing goods to the UK

Source gov.uk

Latest Posts in "United Kingdom"

- VAT: Cattle Bed and Breakfast Service Is Single Standard-Rated Supply, Appeal Dismissed

- HMRC Requires Online Registration for Tax Advisers’ Agent Services Account Starting May 2026

- FTT Upholds HMRC Refusal of Input VAT Recovery Without Invoices in Mochars Ltd Case

- Tribunal Rules EV Charging Points Qualify for Reduced 5% VAT Rate Under Domestic Use Provision

- Who Can Reclaim Import VAT in the UK? HMRC Rules on Ownership and Importer of Record