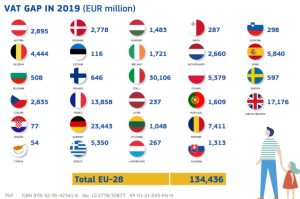

EU Member States lost an estimated €134 billion in Value-Added Tax (VAT) in 2019, according to a new report released by the European Commission today. This figure represents revenues lost to VAT fraud and evasion, VAT avoidance and optimisation practices, bankruptcies and financial insolvencies, as well as miscalculations and administrative errors. While some revenue losses are impossible to avoid, decisive action and targeted policy responses could make a real difference, particularly when it comes to non-compliance.

In 2019,

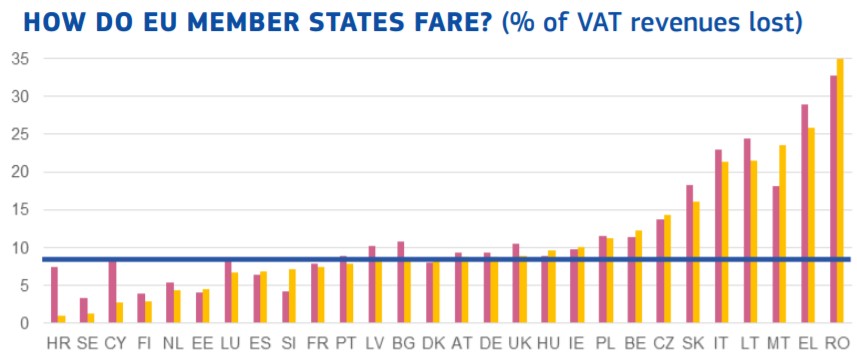

- Romania recorded the highest national VAT compliance gap with 34.9% of VAT revenues going missing in 2019, followed by Greece (25.8%) and Malta (23.5%).

- The smallest gaps were observed in Croatia (1.0%), Sweden (1.4%), and Cyprus (2.7%).

- In absolute terms, the highest VAT compliance gaps were recorded in Italy (€30.1 billion) and Germany (€23.4 billion).

- Q&A

- Factsheet

- Full report with detailed information per Member State

- Commission Action Plan for fair and simple taxation supporting the recovery

- Commission proposals for far-reaching reforms of the EU VAT system

Source ec.europa.eu

Latest Posts in "European Union"

- Playing Music Without Required License Is a Taxable Service, Says Advocate General

- PEM Zone: Implementation Status and Legal Fragmentation of Revised Origin Rules from January 2026

- Innovative Customs Education Workshop Spurs Collaboration; Final Chance for Universities to Apply for EU Recognition

- Briefing documents & Podcasts: VAT concepts explained through ECJ/CJEU cases on Spotify

- Navigating VAT Exemptions: Recent ECJ Judgments and Their Implications for Intra-Community Transactions and Imports