Article 194 of the EU VAT Directive 2006/112/EC allows Member States of the European Union to implement the so-called ”Domestic Reverse Charge”.

This means that

- the VAT liability

- on a supply of goods or services

- by non-established entities in the Member State where the VAT is due

- is shifted to the customer.

For instance, a supply of goods within country A typically with VAT charged on the invoice, by a non-established entity, may be invoiced without VAT. The customer in this case will need to apply reverse-charge.

The application of this article is Optional. The conditions are set by each Member State. Both the status of the supplier and customer needs to be considered.

Article 194 of the EU VAT Directive 2006/112/EC

Article 194

1. Where the taxable supply of goods or services is carried out by a taxable person who is not established in the Member State in which the VAT is due, Member States may provide that the person liable for payment of VAT is the person to whom the goods or services are supplied.

2. Member States shall lay down the conditions for implementation of paragraph 1.

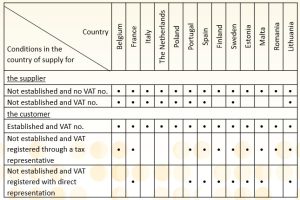

Overview implementation art. 194 in the EU Member States

A business case with a (•) in the conditions applicable for both the supplier and customers is subject to reverse-charge.

Latest Posts in "European Union"

- Comments on ECG T-689/24: Confirms Incompatibility of Polish Input VAT Deduction Rules with EU Law

- Electricity Breakdown at Customs: HS 8502 or HS 8504 – 0% or 10% Duty?

- Conference Vienna University: Court of Justice of the European Union: Recent VAT Case Law (March 10-12)

- Comments on ECJ Case T-643/24: Unauthorised Music Use Qualifies as VAT-Taxable Service

- EU Approves Updated E-Invoicing Standard EN 16931-1 for B2B and 2030 Digital Reporting