(1) Chapter 7, Accounting for GST;

(2) Chapter 8, Payment of GST;

(3) Chapter 9, Refund of net amount; and

(4) Chapter 10, Registration

comes into force on the 1st day of the 7th month of 2022

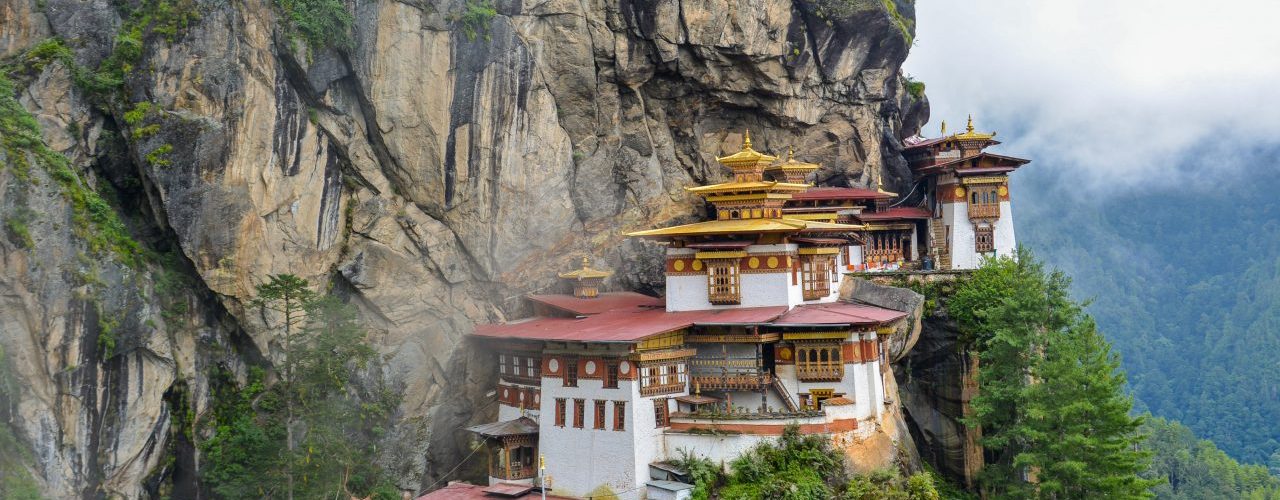

Source gov.bt

Latest Posts in "Bhutan"

- Gelephu Mindfulness City Retains Sales Tax, Exempt from Bhutan’s GST During Transition Period

- Ensuring GST Success: Public Awareness, Transparent Billing, and Strong Regulatory Oversight Essential

- Bhutanese Consumers Face Double Taxation and Price Hikes During GST Transition Period

- Only Registered Businesses May Collect GST: Public Notification from Bhutan’s Revenue & Customs

- Bhutan Launches GST: Modernising Taxation, Protecting Households, and Boosting Economic Resilience