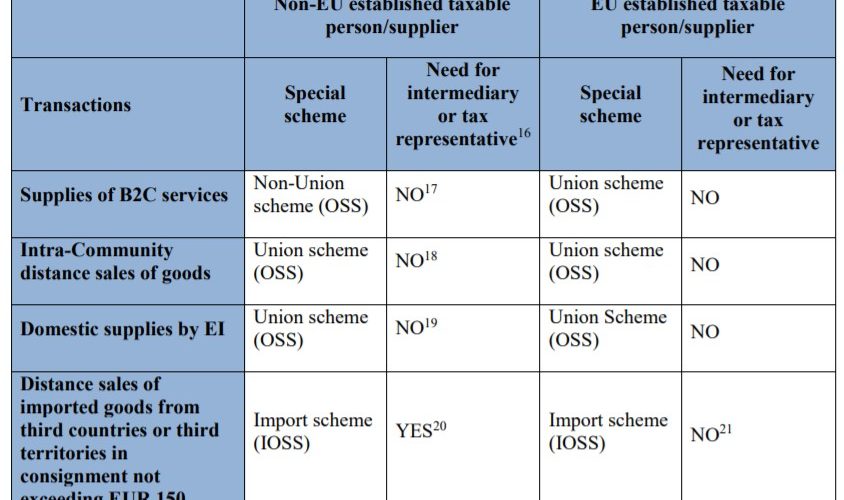

The new provisions modify the existing VAT special schemes15 laid down in the VAT Directive (non-Union scheme, Union scheme) and add a new one (import scheme). The below table provides an overview of the amendments that apply as from 1 July 2021.

- 17 Member States may not oblige non-EU suppliers to appoint a tax representative to use the non-Union scheme (Article 204 of the VAT Directive).

- 18 According to Article 204 of the VAT Directive, Member States may in this case require the taxable person to appoint a fiscal representative who will be the person liable to pay VAT.

- 19 According to Article 204 of the VAT Directive, Member States may in this case require the taxable person to appoint a fiscal representative who will be the person liable to pay VAT.

- 20 Except for a supplier established in a third country with which the EU has concluded an agreement on mutual assistance – see further details in chapter 4.

- 21 No obligation to appoint an intermediary to use the import scheme, but the taxable person is free to do so.