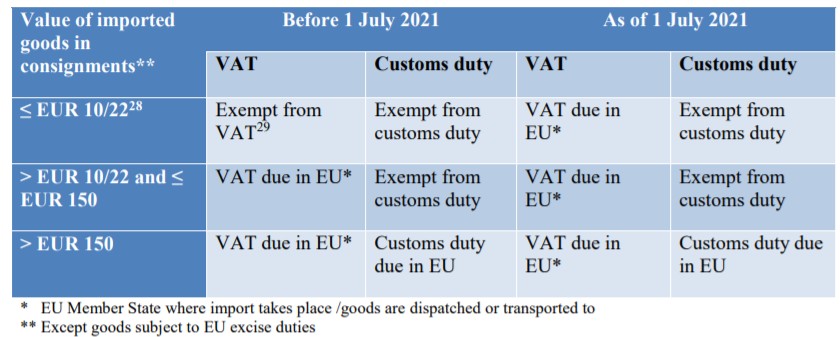

As from 1 July 2021 VAT is due on all low value goods imported into the EU. At the same time the following simplifications for the collection of VAT are introduced:

- The special scheme for distance sales of goods imported from third countries or third territories – The import scheme/Import One Stop Shop or IOSS

- The special arrangements for declaration and payment of import VAT

In practice, from 1 July 2021, the VAT on low value goods can be paid as follows:

- Payment as part of the purchase price to the supplier/electronic interface using the IOSS whereby the importation of the related goods is exempt from VAT.

- Payment upon importation in the EU, if the supplier/electronic interface does not use the IOSS:

- To the person presenting the goods to customs (i.e. lodging a customs declaration for release for free circulation) if that person chooses to use the special arrangements; or

- Using standard VAT collection mechanism.

Regardless of the application of the import scheme or the special arrangements for declaration and payment of import VAT, customs formalities must be completed for low value goods imported into the EU.

See also EU VAT and B2C E-Commerce: Overview of the changes on 1 July 2021

.

Latest Posts in "European Union"

- General Court VAT case T-851/25 (Roenes) – Questions – Transfer of a Totality of Assets: Economic Continuity vs. Supplier Intention

- Business Leaders Call on EU to Modernize Customs Union and Revive Türkiye Membership Talks

- EU VAT Compliance Gap Hits €128 Billion in 2023, Driven by Six Major Economies

- EU Triangular Transactions: More Than Three Parties Allowed, Rules European Court in 2025 Decision

- INTA Reviews EU Proposal to Extend CBAM to Downstream Goods and Strengthen Anti-Circumvention Measures