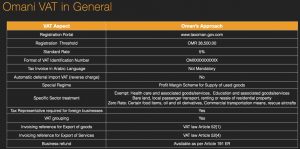

This is currently only available in Arabic, provides detailed rules for Oman’s new VAT regime, including in relation to the imposition of VAT, the taxable value and calculation of VAT, the exempted and zero-rated supplies, registration requirements, invoice requirements, VAT payment and refund requirements, etc.

Source

- Oman VAT Regulations (Halil Erdem)

- Thomas Vanhee /Aurifer

- Orbitax

- Ministerial Decision 53/2021 in the Official Gazette

- Mark Junkin

Latest Posts in "Oman"

- Oman E-Invoicing (Fawtara) Guide

- Peppol-Based E-Invoicing Mandate for Omani Businesses

- Oman E-Invoicing: Mandatory Rollout, Requirements, and Timeline for B2B, B2C, and B2G Transactions

- Oman Launches VAT Refund Scheme to Boost Tourism and Retail Competitiveness in the Gulf Region

- Oman to Launch VAT Refund Scheme for Tourists to Boost Regional Tourism Appeal