EU Member States can introduce a temporary VAT exemption for the sale of corona vaccines and test kits to hospitals, doctors and individuals, and for closely related services.

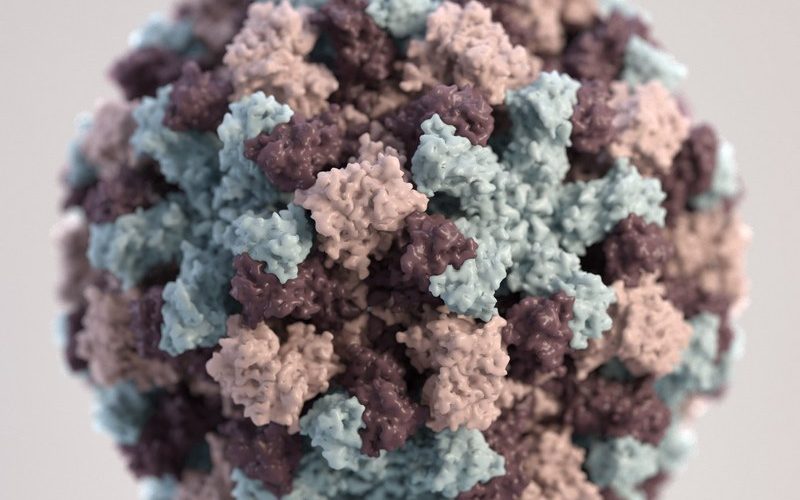

The measures decided today only concern COVID-19 vaccines authorised by the Commission or by the member states and COVID-19 test kits that comply with the applicable EU legislation.

They will apply until 31 December 2022.

Member states may also apply a reduced VAT rate to testing kits and closely related services, if they choose to do so. This possibility is already available for vaccines.

Sources:

Latest Posts in "European Union"

- Comments on ECJ C-472/24: AG Opinion on Taxation of Virtual Gold in Online Gaming

- Briefing document & Podcast: ECJ C-564/15 (Farkas) – Non-application Reverse-Charge, 50% tax penalty is disproportionate

- Pierrakakis at ECOFIN: Innovation and Digitalization as Europe’s Competitiveness Drivers

- Three Plead Guilty in €6.5 Million Tax Evasion and Money Laundering Case

- Transfer Pricing Adjustments and VAT Implications: Impact of Recent CJEU Decisions