The concept of VAT is relatively new within the GGC region, with the Kingdom of Saudi Arabia and the United Arab Emirates implementing VAT on January 1, 2018, with the Kingdom of Bahrain adopting VAT the following year. This article gives an overview of the VAT rules in the GCC countries, focusing on the introduction of a VAT in Oman, planned for 1 April 2021.

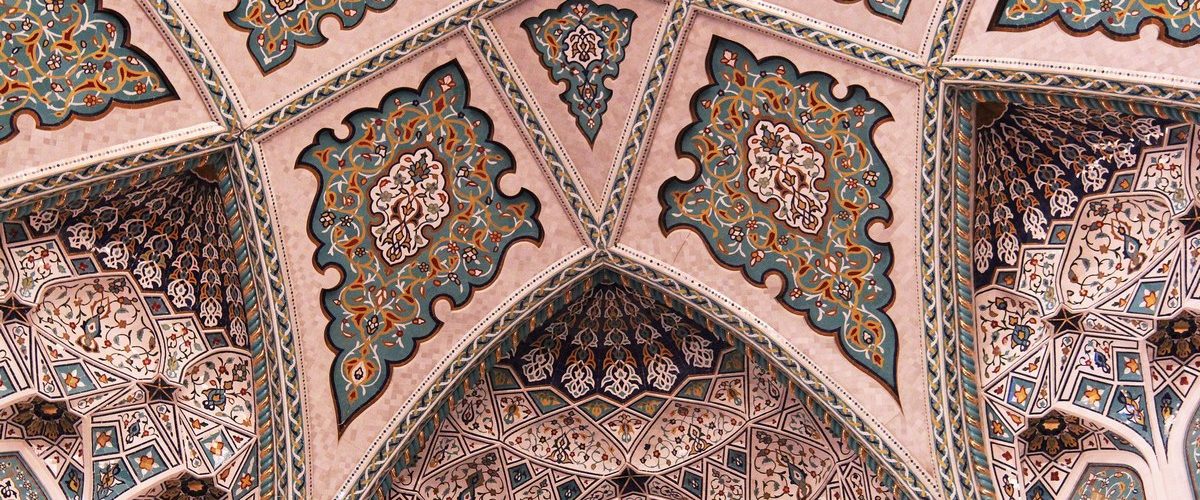

Source Oman Observer

Latest Posts in "Oman"

- The Oman Tax Authority becomes a Peppol Authority

- Salalah Free Zone Advances $3.3 Billion Projects in Petrochemicals, Green Energy, Food, and Logistics

- Oman e-Invoicing Mandate 2026: Key Updates from the Oman Tax Authority the second consultative workshop

- Oman Adopts Peppol E-Invoicing Framework for B2B, B2G, and B2C Transactions from 2026

- Oman Unveils E-Invoicing Roadmap and Data Dictionary for VAT Compliance Rollout